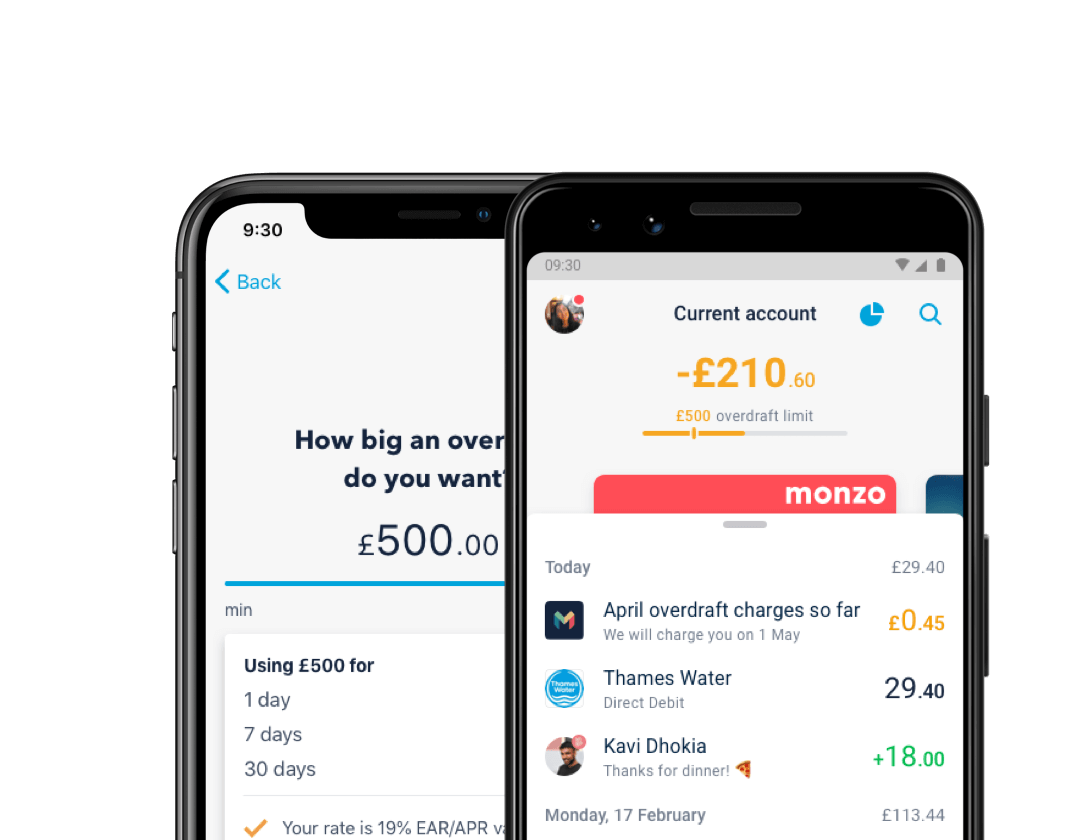

Overdrafts

Arranged overdrafts can be ideal if you need to borrow a little extra money to tide you over every now and then.

Overdrafts are designed for short term borrowing, and they’ll cost you less if you pay them back quickly.

Monzo overdrafts

19%, 29% or 39% EAR (variable)

As a representative example, if you use an arranged overdraft of £1,000 for 30 days, with 39.0% EAR/APR (variable), it would cost you £27.45. Your exact rate will depend on your credit score, and you can see what rate you’re on in your Monzo app.

We’ll always tell you the exact rate you’ll pay, and what that means in pounds, before you borrow from us.

Limits of up to £1,000

If you’re eligible you could have an overdraft limit up to £1,000. As always, this won’t apply to everyone and we’re very careful about only giving people what we’re confident they can safely afford to borrow.

You can change your limit and cancel your overdraft at any time from your app. If you want to to do so you’ll need to pay the amount you borrowed back, plus any interest.

No extra fees

We won’t charge you any extra fees for going into your overdraft, and we’ll always tell you when you go into it.

What are EAR and APR?

EAR stands for effective annual rate.

This is equivalent to the rate of interest you'll pay if you're overdrawn for a year. You'll pay interest on the amount you're overdrawn by, and on the interest that builds up from being overdrawn. So you'll pay less if you regularly pay off your overdraft. EAR doesn’t include other fees, like hidden or late fees – but we don’t charge these anyway.

APR stands for annual percentage rate.

It is calculated in the same way as the EAR plus any additional fees (like hidden or late fees) but we don’t charge these anyway so our EAR and APR are the same.

Variable means we have the right to change the rate, but we’ll always give you notice if we do.

You can use the calculator below to figure out how much you would pay depending on your personal rate.

Arranged and unarranged overdrafts

When you switch on an overdraft with Monzo that's called an arranged overdraft. If you go over your arranged overdraft limit or you don't have an arranged overdraft we'll reject payments (for free), but there are some times when we can't reject payments. We've explained how it works below:

If you go over your agreed overdraft limit

We’ll reject any payments that take you over your limit, and you won’t be able to take cash out. The only exceptions are ‘offline’ payments, like those you make to TfL. We can’t reject these, so you’ll go into an unarranged overdraft, but we'll tell you as soon as this happens. You'll have until midnight to add money to your account, so you can avoid charges or any impact on your credit score (which might make it harder for you to borrow in the future).

If you go into an unarranged overdraft we’ll charge you the same rate we would if you were using your arranged overdraft, and we will cap the charges at £15.50 per month, so you will never pay more than that.

If you don’t have an arranged overdraft

If your account is empty, we’ll reject payments unless they’re payments as described above. We’ll send you a notification and you'll have until at least midnight that day to add some money.

If you don’t pay it back in time, we’ll charge you interest at 39% EAR (variable). The monthly cap on unarranged overdraft charges for Monzo personal accounts is £15.50. Further details can be found here.

Check if you're eligible for an overdraft

You can use this eligibility checker to see if you’re likely to get an overdraft with us. Please note a few things:

- Using this checker doesn’t guarantee you’ll get an overdraft with us

- The outcome is based solely on the accuracy on the information you give us

- Using the checker won't affect your credit file in any way

- Any overdraft offered by Monzo will depend on a full eligibility assessment (this will happen when you apply for an overdraft in our app)

Eligibility Results

Remember: these results are not definite, this is just a guide