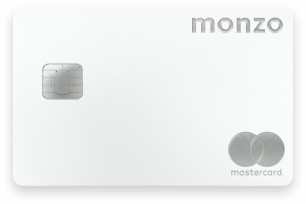

Banking that makes a statement

Turn heads with our white metal card and enjoy peace of mind with worldwide phone and travel insurance, interest and much more.

Protection for your prized possession

Phone insurance that covers theft, loss, accidental damage, even cracked screens.

For phones worth up to £2,000 and accessories up to £300, like headphones and chargers. With £75 excess. Exclusions apply.

Provided by Assurant

Worldwide family travel insurance

Stress-free travel with insurance that covers cancellation up to £5,000, medical bills up to £10m, lost valuables up to £750, winter sports and more. Worth £159 a year on average.

Multi-trip cover for you, your partner and family anywhere in the world, including the UK and the US. With £50 excess.

Learn more about our travel insurance to see the full AXA terms and conditions, including general and coronavirus exclusions. The age limit for children is 19 years inclusive (or 21 if in full time education) at the start of a trip.

Provided by AXA

Your money makes you money

Earn 1.50%/1.49% AER/Gross (variable) interest on up to £2,000 in your account balance and regular Pots (not including Savings Pots).

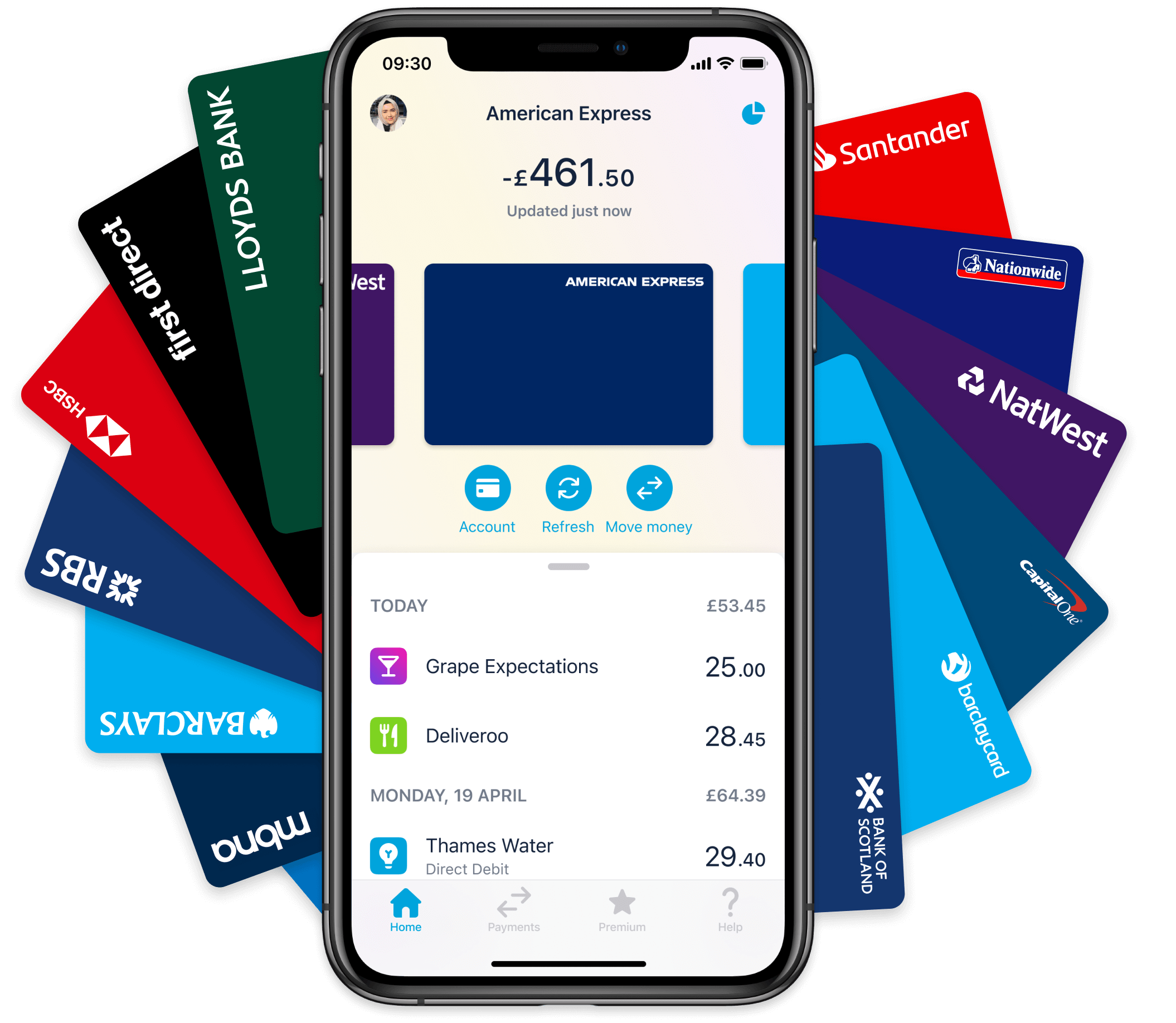

See Amex and other accounts, in Monzo

Get a clear view of your finances by adding your other bank accounts and credit cards to Monzo. See your balances and transactions, and move money around with easy bank transfers. Terms and conditions apply.

Features

Interest on your money

Earn 1.50%/1.49% AER/Gross (variable) interest on up to £2,000 in your account balance and regular Pots (not including Savings Pots).

Discounted airport lounge access

Get discounted access to over 1,000 lounges worldwide for you and your friends.

£600 fee-free withdrawals abroad

Take out up to £600 cash abroad for free every 30 days. That's 3 times more than our regular Monzo account.

Advanced roundups

Automatically put aside 2, 5 or 10 times as much spare change every time you spend.

Stay safe with virtual cards

We're all shopping online more, so it's important to be extra careful. Keep your physical card details safe by using virtual cards for online payments.

Protect your physical card

Use your virtual cards’ unique details online instead of the ones on your physical card.

Manage online subscriptions

Avoid updating your payment details everywhere because your physical card got lost or stolen.

Have up to 5 at any time

Personalise your cards by giving them names and picking from a range of colours.

Track your credit health

See your credit score in the app and track how it changes each month.

With helpful guides on how credit scores work and tips on ways you could improve yours.

Powered by TransUnion.

Treat yourself

RAC Breakdown Cover: Cover from £4.75 a month including free Legal Care Plus. Terms apply.

Laka: 10% off cycle insurance every month for a year for new Laka customers

Beer Hawk: 5 craft beers and a glass for £10, plus £10 off your next order

Patch: 15% off all plant and plant pot orders over £50. Learn more.

Naked Wines: Over 50% off 6 bottles of wine when you sign up. Learn more.

Babylon Health: 20% off an annual virtual GP subscription and free access to COVID-19 Care Assistant

Fiit: 25% off a home workout membership. Learn more.

And more. See them all in the app. Conditions apply.

![]()

Packed with the best of Monzo

A UK current account

We're a fully licensed UK bank, which means we're regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Protection for your money

Your eligible deposits in Monzo are protected by The Financial Services Compensation Scheme (FSCS) up to a value of £85,000 per person.

A new way to bank

With features like instant spending notifications, simple ways to send money, Pots for separating it and monthly spending summaries.

Friendly support

Got a problem? We're here to help. Just message us in the app.

Loans and overdrafts

We offer loans up to £15,000 and overdrafts up to £1,000. You can check if you're eligible without affecting your credit score.

Interest on your savings

Earn interest on your savings by choosing an easy access or fixed term Pot. Your money with the savings provider is protected by the FSCS for amounts up to £85,000. Minimum £10 deposit to open.

Pick an account

We're making money work for everyone, so we have different accounts for different needs.

Monzo

Free

A UK current account

With savings, borrowing and overdrafts

Your money is protected by the FSCS

Your eligible deposits are protected by the FSCS up to a value of £85,000 per person

Fee-free UK bank transfers

Send money to any UK bank for free

Pots for separating money

Put money aside from your balance

Award-winning support

Through the app, if you need it

Instant notifications

See when, where and how you spend

Apple Pay and Google Pay

Spend using your phone

Spending categories

Get a clear view of your spending

Monzo Plus

£5 per month

All free Monzo features

Other accounts, in Monzo

See your other accounts in Monzo

1.00% AER/Gross (variable) interest up to £2,000

On your balance and regular Pots

Holographic card

Exclusive to Monzo Plus

Custom categories

Plus, divide payments into multiple categories.

Virtual cards

Avoid using your physical card online

Advanced roundups

Make your spare change go further

Credit Tracker

See how your credit score changes

Offers

15% off Patch and many more

Fee-free withdrawals abroad

Up to £400 free every 30 days

Auto-export transaction

Live updates to Google Sheets

1 free cash deposit a month

At PayPoints across the UK

Monzo Premium

£15 per month

All free Monzo features

All Monzo plus features

Metal card

Exclusive to Monzo Premium

Phone insurance

Covers loss, damage, theft, and cracks

Worldwide travel insurance

Cover for you and your family

Interest on balance and regular Pots

1.50%/1.49% AER/Gross on up to £2,000

Discounted airport lounge access

You and guests can travel in style

Fee-free withdrawals abroad

Up to £600 every 30 days

5 free cash deposits a month

At PayPoints across the UK

Not sure what to pick?

Compare each account to find the right one for you