Put money in your hands

Full financial visibility, with your other bank accounts and credit cards all in one place. Get interest on your money, personalised budgeting and so much more.

Get full financial visibility

Add your other bank accounts and credit cards so they're visible in the Monzo app, then categorise transactions like you do with your Monzo account.

See your balances and transaction history for up to 3 years, and move money around with easy bank transfers.

Stay safe online with virtual cards

We're all shopping online more, so it's important to be extra careful. Keep your physical card details safe by using virtual cards for online payments.

Protect your physical card

Use your virtual cards’ unique details online instead of the ones on your physical card.

Manage online subscriptions

Avoid updating your payment details everywhere because your physical card got lost or stolen.

Have up to 5 at any time

Personalise your cards by giving them names and picking from a range of colours.

Understand your spending better

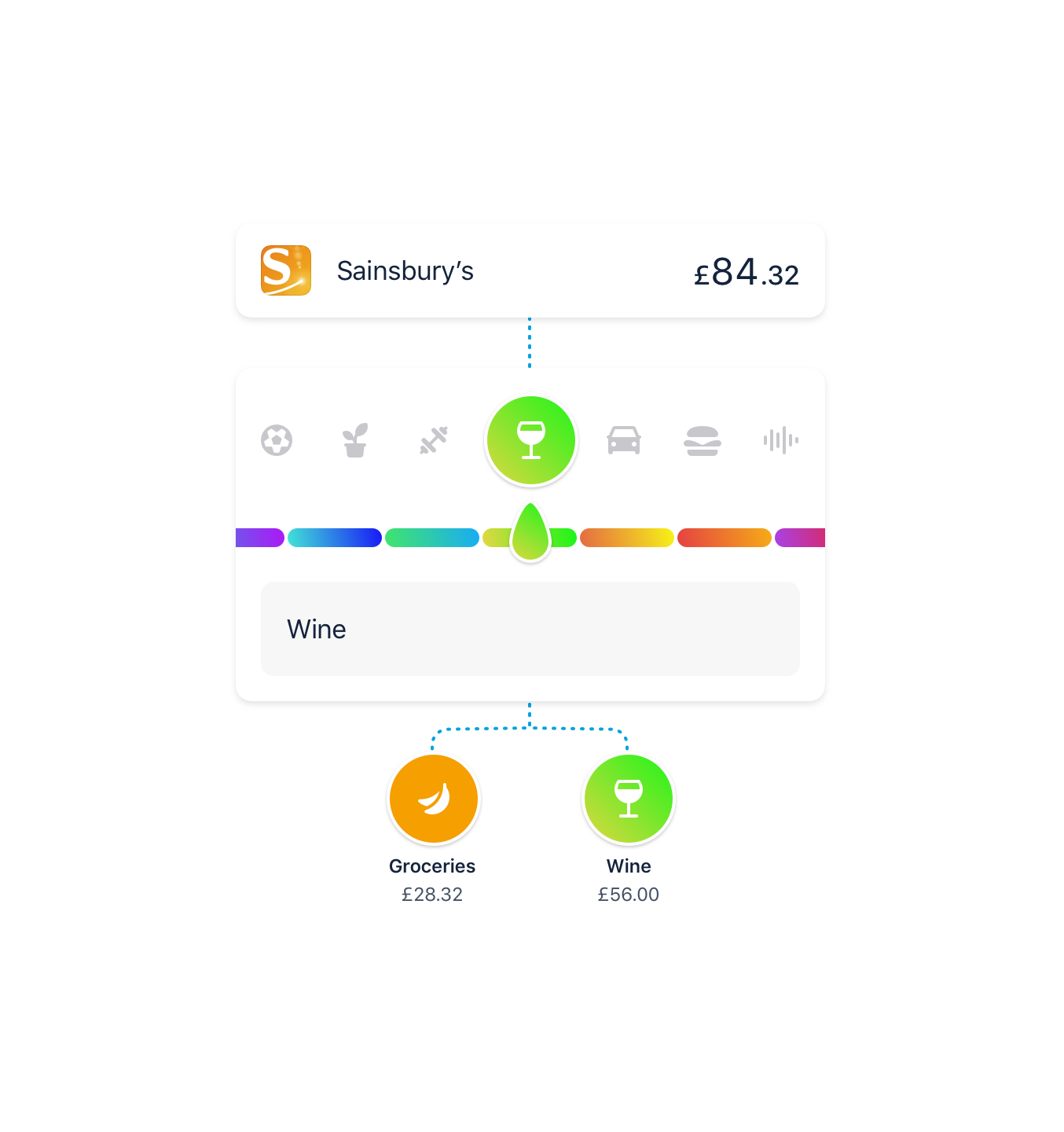

Create custom categories to group your spending in ways that work for you and your lifestyle.

Divide single transactions into multiple categories to group your spending, your way.

Auto-export transactions to Google Sheets as they happen, for a detailed look at your spending.

Features

1.00% AER/Gross (variable)

Earn interest on up to £2,000 in your account balance and regular Pots (not including Savings Pots).

Custom spending categories

Personalise your spending breakdown by creating your own spending categories.

£400 fee-free withdrawals abroad

Take out up to £400 cash abroad for free every 30 days. That's double the amount you can withdraw for free with our regular Monzo account.

Advanced roundups

Automatically put 2, 5 or 10 times as much spare change into savings every time you spend.

Track your credit health

See your credit score in the app and how it changes each month.

With helpful guides on how credit scores work and tips for improving yours.

Powered by TransUnion

Treat yourself

RAC Breakdown Cover: Cover from £4.75 a month including free Legal Care Plus. Terms apply.

Laka: 10% off cycle insurance every month for a year for new Laka customers

Beer Hawk: 5 craft beers and a glass for £10, plus £10 off your next order

Patch: 15% off all plant and plant pot orders over £50. Learn more.

Naked Wines: Over 50% off 6 bottles of wine when you sign up. Learn more.

Babylon Health: 20% off an annual virtual GP subscription and free access to COVID-19 Care Assistant

Fiit: 25% off a home workout membership. Learn more.

And more. See them all in the app. Conditions apply.

![]()

Packed with the best of Monzo

A UK current account

We're a fully licensed UK bank, which means we're regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Protection for your money

Your eligible deposits in Monzo are protected by The Financial Services Compensation Scheme (FSCS) up to a value of £85,000 per person.

A new way to bank

With features like instant spending notifications, simple ways to send money, Pots for separating it and monthly spending summaries.

Friendly support

Got a problem? We're here to help. Just message us in the app.

Loans and overdrafts

We offer loans up to £15,000 and overdrafts up to £1,000. You can check if you're eligible without affecting your credit score.

Interest on your savings

Earn interest on your savings by choosing an easy access or fixed term Pot. Your money with the savings provider is protected by the FSCS for amounts up to £85,000. Minimum £10 deposit to open.

Pick an account

We're making money work for everyone, so we have different accounts for different needs.

Monzo

Free

A UK current account

With savings, borrowing and overdrafts

Your money is protected by the FSCS

Your eligible deposits are protected by the FSCS up to a value of £85,000 per person

Fee-free UK bank transfers

Send money to any UK bank for free

Pots for separating money

Put money aside from your balance

Award-winning support

Through the app, if you need it

Instant notifications

See when, where and how you spend

Apple Pay and Google Pay

Spend using your phone

Spending categories

Get a clear view of your spending

Monzo Plus

£5 per month

All free Monzo features

Other accounts, in Monzo

See your other accounts in Monzo

1.00% AER/Gross (variable) interest up to £2,000

On your balance and regular Pots

Holographic card

Exclusive to Monzo Plus

Custom categories

Plus, divide payments into multiple categories.

Virtual cards

Avoid using your physical card online

Advanced roundups

Make your spare change go further

Credit Tracker

See how your credit score changes

Offers

15% off Patch and many more

Fee-free withdrawals abroad

Up to £400 free every 30 days

Auto-export transaction

Live updates to Google Sheets

1 free cash deposit a month

At PayPoints across the UK

Monzo Premium

£15 per month

All free Monzo features

All Monzo plus features

Metal card

Exclusive to Monzo Premium

Phone insurance

Covers loss, damage, theft, and cracks

Worldwide travel insurance

Cover for you and your family

Interest on balance and regular Pots

1.50%/1.49% AER/Gross on up to £2,000

Discounted airport lounge access

You and guests can travel in style

Fee-free withdrawals abroad

Up to £600 every 30 days

5 free cash deposits a month

At PayPoints across the UK

Not sure what to pick?

Compare each account to find the right one for you