Monzo Business

It just works, so you can too

Monzo Business helps small businesses stay on top of their finances. Starting at no monthly fees.

What you need to know

Get better visibility and more control over all your money with a Monzo Business bank account. Less time on finances means more time for the important stuff.

We're a fully regulated UK bank

- We're regulated by all the same rules as high street banks

- Open a business account online, straight from your phone

- Award-winning customer support, 24/7

You get the best of Monzo

- Move money easily with free, instant bank transfers (UK only)

- Get notified the second you pay, or get paid

- Set money aside, separate from your balance, with Pots

Built for your business

- Manage your business account online wherever you are, with mobile and web access

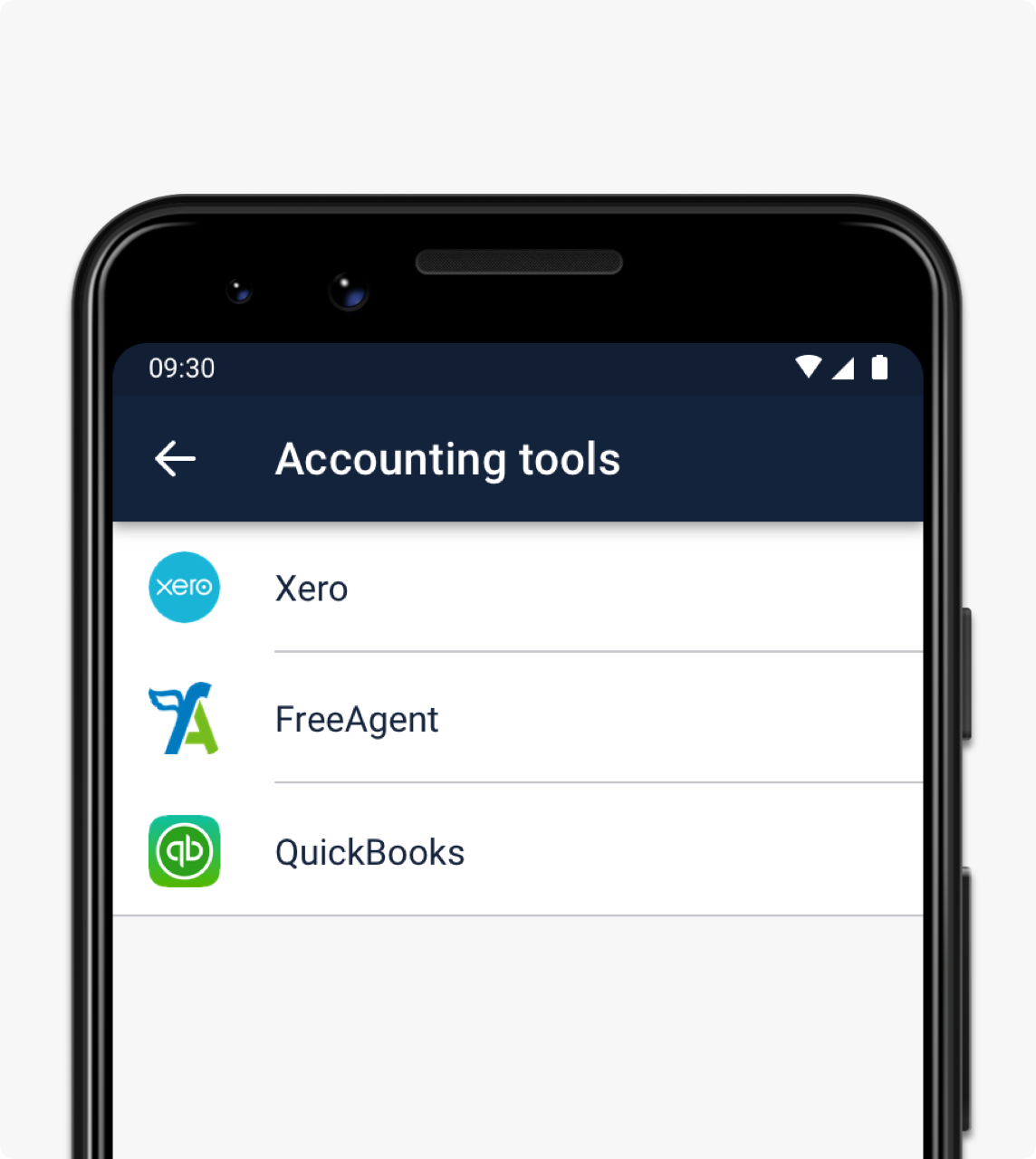

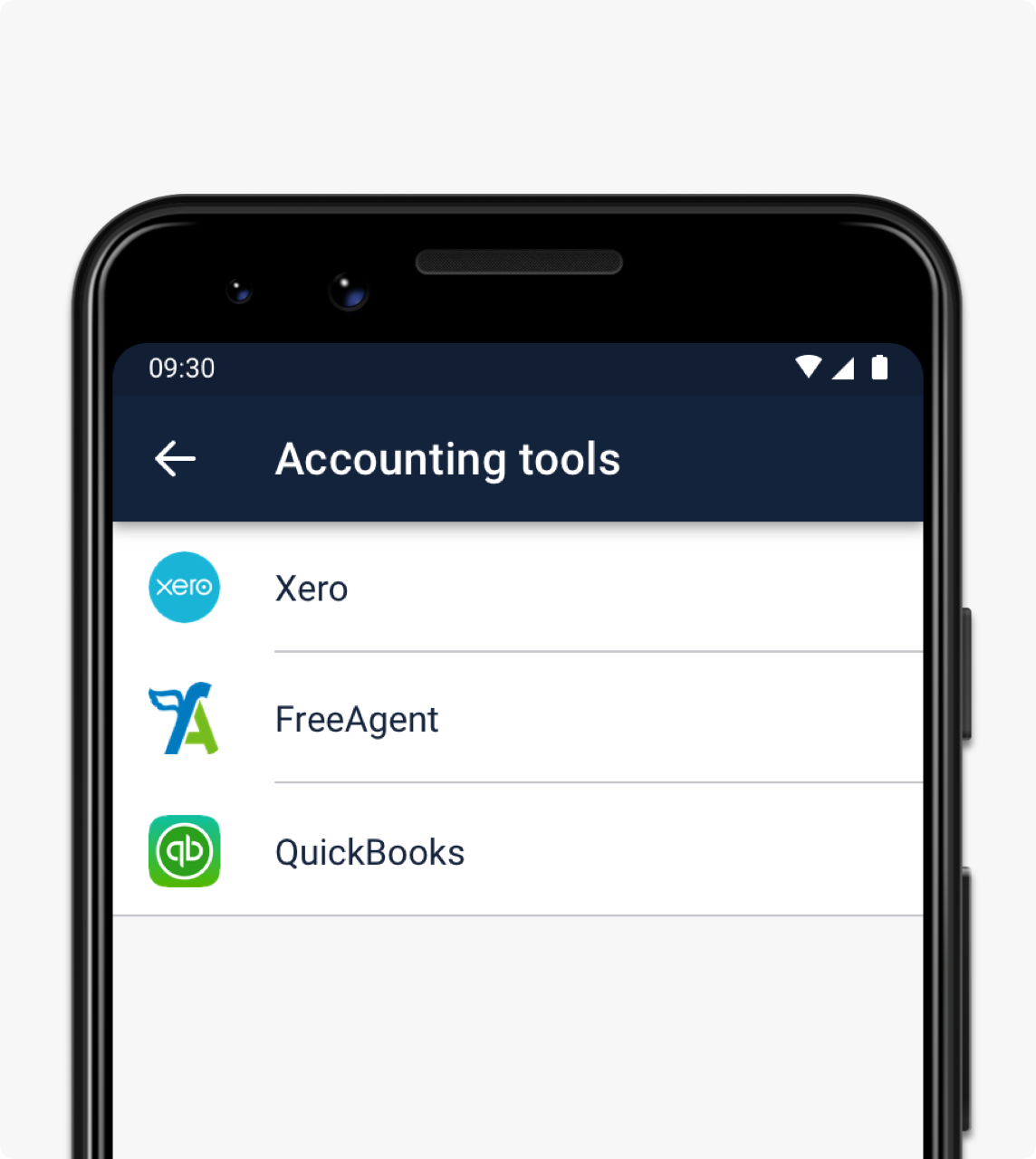

- Integrate accounting tools so everything's in one place

- Keep on track with in-app invoicing and digital receipts

We're here to help, 24/7

How we help:

- Chat to us in app any time, or call or email if you'd prefer

- We'll answer your questions and help solve any problems you have

- No need for branches, and no need to make an appointment

Simple pricing, no commitment

| Built for business | Pro£5/m Your business' finances, taken care of. | LiteFree The best of Monzo, for your business. |

|---|---|---|

Choose a percentage to automatically set aside for tax, every time you’re paid. | Yes | No |

Integrate with Xero, FreeAgent, QuickBooks or export your transactions. | Yes | No |

Manage finances together with access for up to 2 others (limited companies only). All users get a business debit card. | Yes | No |

Create, send and track invoices, in the app and on the web. | Yes | No |

Save time and money with offers for your business. | Yes | No |

New users: get the cloud accounting platform for 6 months free. £180 value. T&Cs apply. | Yes | No |

Manage your money at home, in the office and on the go. | Yes | Yes |

Complete with a pebble grey or slate grey finish. | Yes | Yes |

Award-winning, human help in the app, 24/7. | Yes | Yes |

Send and receive UK bank transfers, fee-free. | Yes | Yes |

Neatly separate your money to suit your business, all in one account. | Yes | Yes |

Get notified the second you pay, or get paid. | Yes | Yes |

Break down your spending with monthly budgets and transaction categories. | Yes | Yes |

Add receipts to payments while you’re on the go. | Yes | Yes |

Because we're a UK fully regulated bank. | Yes | Yes |

Open a full bank account from your phone. Switch from your old bank, hassle-free. | Yes | Yes |

Pay with your phone, on the go. | Yes | Yes |

We don’t mark up the exchange rate, unlike most other banks. | Yes | Yes |

Keep track of all your scheduled payments in one place. | Yes | Yes |

Post cheques to us for free. Pay in cash at PayPoint for £1, up to £1,000 every 6 months. | Yes | Yes |

So your money’s protected, just like the high street. | Yes | Yes |

Payment approval and card freezing. Plus fingerprint, face and PIN protection. | Yes | Yes |

Simple pricing, no commitment

| Features | Pro | Lite |

|---|---|---|

| Monthly price | £5 | Free |

| Tax Pots | Yes | No |

| Integrated accounting | Yes | No |

| Multi-user access (Ltds only) | Yes | No |

| Invoicing | Yes | No |

| Exclusive offers | Yes | No |

| 6 months Xero free (optional) | Yes | No |

| Mobile and web access | Yes | Yes |

| Business debit card | Yes | Yes |

| 24/7 customer support | Yes | Yes |

| Free, instant UK bank transfers | Yes | Yes |

| Pots to separate money | Yes | Yes |

| Instant notifications | Yes | Yes |

| Budget and categorise spending | Yes | Yes |

| Digital receipts | Yes | Yes |

| Full UK current account | Yes | Yes |

| Mobile signup and switching | Yes | Yes |

| Apple Pay and Google Pay | Yes | Yes |

| Fee-free spending abroad | Yes | Yes |

| Manage scheduled payments | Yes | Yes |

| Pay in cash and cheques | Yes | Yes |

| £85,000 FSCS protection (if eligible) | Yes | Yes |

| Advanced security | Yes | Yes |

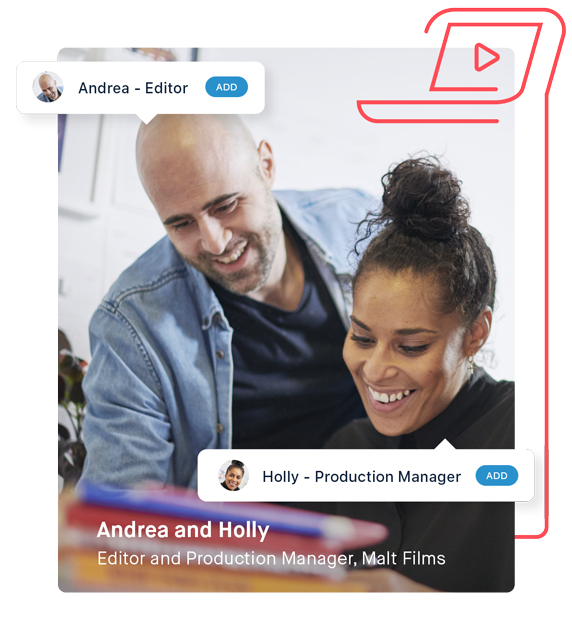

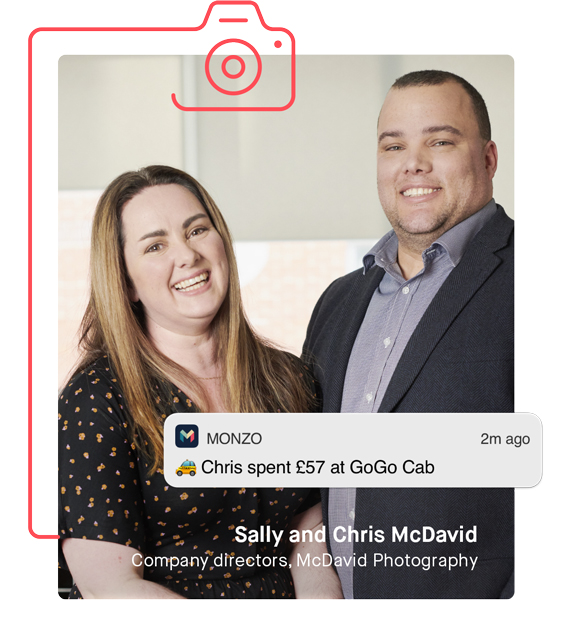

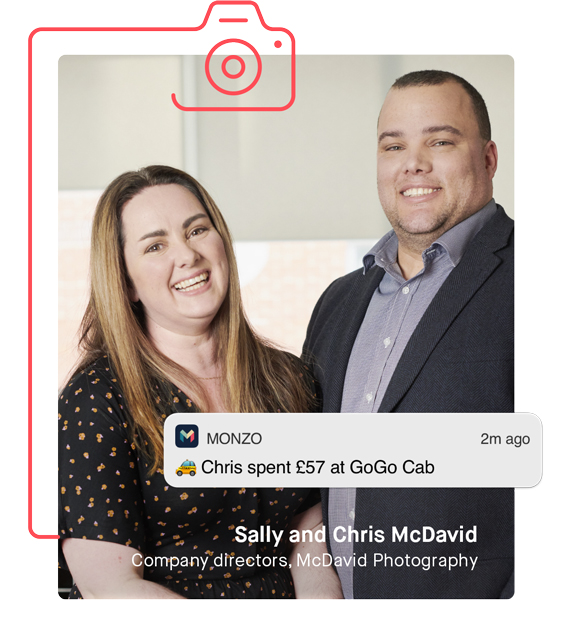

"The team has access. We know who paid what and when. Monzo's allowed us to have transparency."

The Malt Films team uses multi-user access to:

- Manage their finances together

- Improve visibility across the business

- Split up their workload, especially if someone's away

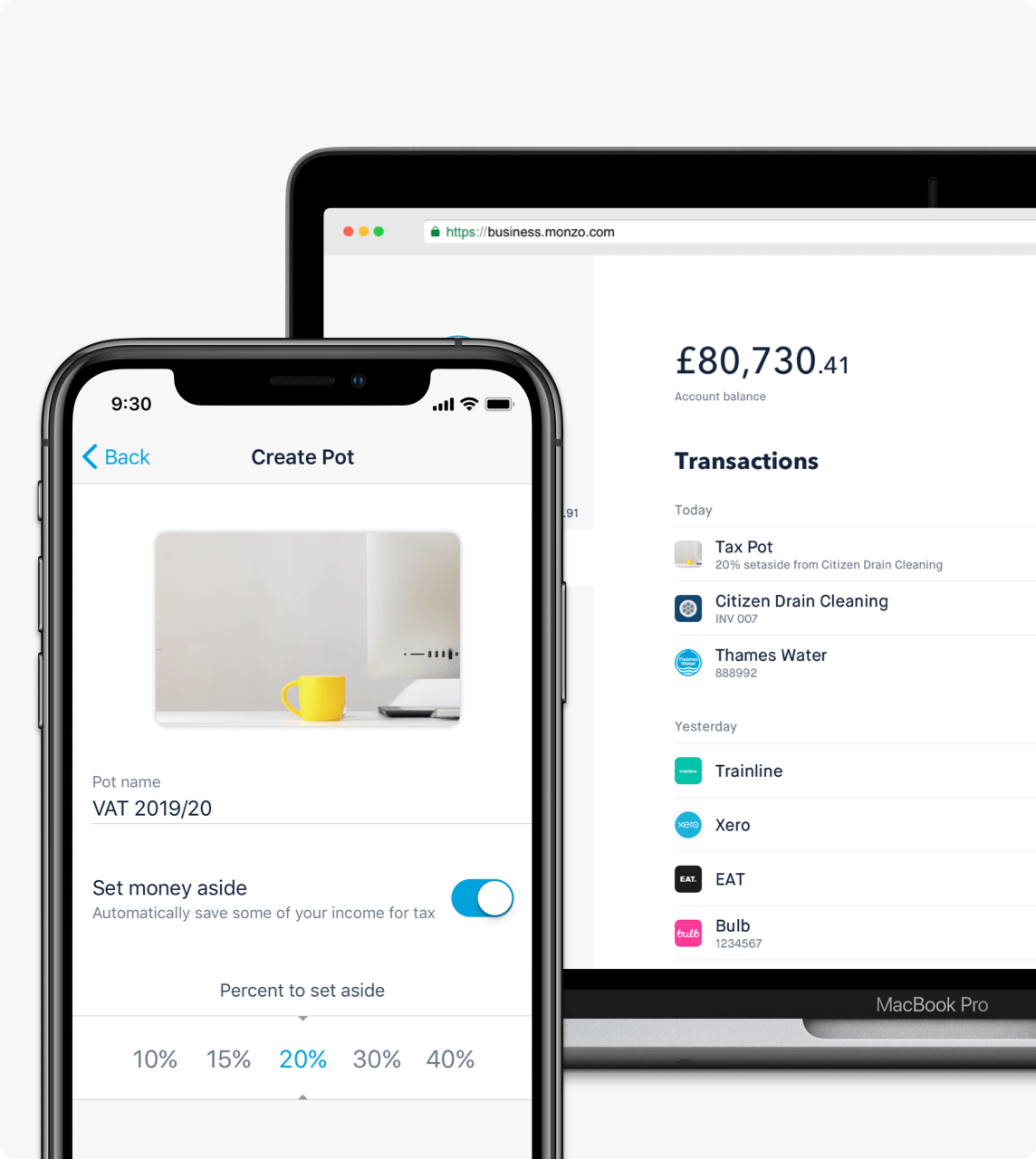

Choose what to set aside for tax

Use Tax Pots to:

- Automatically set a percentage of your income aside when you're paid

- Neatly separate your money, all in one bank account

- Stop worrying about saving, and spend more time on your business

"It's nice to know when you've been paid. You know what's gone out, what's gone in, instantly."

Sally and Chris use instant notifications to:

- Know when they're paid right away

- Keep track of their spending

- Stay on top of their invoices

Meet the people behind the businesses

Monzo Business lets them get on with what they love: running their business.

Automate accounting with tools you already use

Integrate accounting tools like Xero, FreeAgent and QuickBooks to automatically share your balance and transactions every day.

If you use other tools, or don’t use any, easily export a file of your transactions (CSV, PDF or QIF) whenever you need to. We’ll never share your data with anyone else unless you agree to it, or ask us to.

With Monzo Business Pro, new Xero users can get 6 months of the cloud accounting platform free (terms apply). Learn more.

Your questions, answered

Check if you're eligible

You can apply for a business bank account if you’re a sole trader or a registered limited company by shares (Ltd), based in the UK, and if you're an Ltd also a tax resident only in the UK.

Head to our eligibility criteria for more detail on businesses and industries we can and can’t support at the moment.

Your eligible deposits are protected

As a fully regulated UK bank, we’re covered by the Financial Services Compensation Scheme (FSCS). Your eligible deposits in Monzo are protected by the FSCS up to a value of £85,000 per eligible depositor 💰You can find out more about eligible businesses, if you’re interested.

Sign up straight from your phone

We’ll ask some questions about your business to see if you’re eligible.

If you have a Monzo Current Account, apply in your app. If you don’t have a Monzo Current Account, sign up in these 3 steps.

Get started with Monzo Business today

Over 95,000 business owners have already changed the way they do business banking. Sign up from your phone to join them.

Let's talk business

Ideas for everything from getting started, to taking your business to the next level