We want to make money work for everyone, and that includes businesses too 🌍

We've spent the past 12 months building an account that makes banking effortless for small businesses. We've been so inspired by what got you into business in the first place – loving something so much that you wanted to spend all of your time on it, or having the freedom to choose your own projects, your own hours and be your own boss.

Find out more from the people behind the businesses.

We heard about the problems you face with business banking ⛔️

Something we heard over and over again is how much time you spend on banking and admin, rather than focussing on what matters most – running your business.

You told us that opening a business account is a painful process that can take weeks. That you're charged for things you need to do most days, like UK bank transfers. That repetitive financial admin takes hours of your time and that it's hard to keep track of what's coming into, and going out of, your account.

So we've built something that makes business banking effortless ⚡️

We want our business accounts to change the lives of business owners and set a new industry standard for business banking. They're designed to let you get on with running your business, knowing that banking's taken care of.

Monzo Business Pro: your business’ finances taken care of, for £5 per month.

Monzo Business Lite: the best of Monzo but for your business, with no monthly fee.

Both our accounts are full UK current accounts, and we're regulated by all the same rules as high street banks. Plus, your eligible deposits in Monzo are FSCS protected up to £85,000.

Here's what you'll get

No more worrying if you’ve forgotten to save for your tax bill, with Tax Pots (Pro only) 🍯

And no more shifting around between accounts to see where your money is. Choose what percentage of your income you want to set aside for tax. Then whenever you’re paid, we’ll put it in your Tax Pot automatically. You can add or take out money from your Tax Pot any time.

Multi-user access for limited companies (Pro only) 👨👨👧👦

Add up to 2 other people from the app, and start managing your finances together. They can pay people, see incoming and outgoing payments, and edit account information - just like you.

Integrate accounting tools like Xero, FreeAgent and QuickBooks (Pro only) 🔢

Automatically share your balance and transactions every day. No need to switch between tools, or manually upload statements. Keep on top of your accounts with everything in one place, and see where you’re at with a glance. So it's extra clear, we’ll never share your data with anyone else unless you agree to it, or ask us to.

If you use other tools, or don’t use any, easily export a file of your transactions (CSV, PDF or QIF) whenever you need to.

Get notified the second you pay, or get paid, with instant notifications (Pro and Lite) 💵

No need to keep checking your account to know where you stand. You’ll see any money going in and out of your account instantly – as soon as your client's paid you, or you pay a supplier.

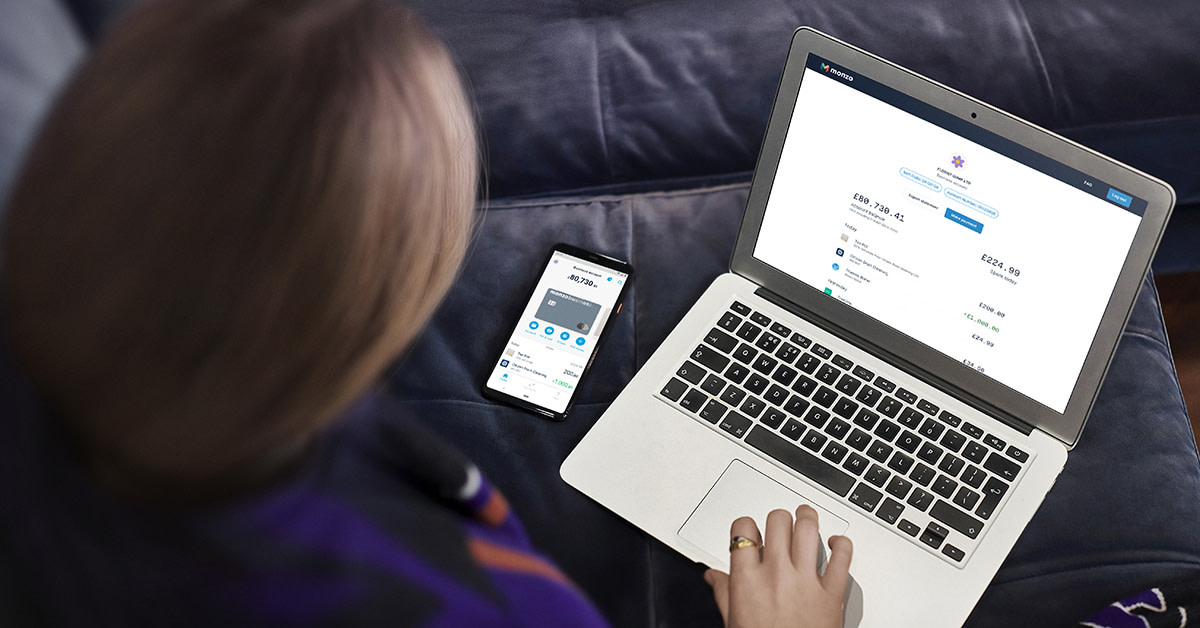

Manage your money from anywhere with mobile and web access (Pro and Lite) 💻

Manage your account from your phone or your laptop. On the web app you can: pay people, export statements and see your transaction history. Plus more coming soon.

Our secure login system means there’s no need to carry around dongles or remember lengthy passwords. Your account’s fully protected, and available wherever you are.

Fee-free UK bank transfers (Pro and Lite) ⚡️

Say goodbye to transaction fees on transfers – it’s completely free. And see at a glance what you’ve sent and received.

Make instant UK bank transfers via Faster Payments. And receive payments from major UK payment schemes, like Faster Payments, CHAPS and Bacs.

24/7 customer support (Pro and Lite) 👥

We’re right here in the app to answer your questions or help solve your problems, 24/7. There's no need to make an appointment or wonder when you’ll hear back.

All this, plus so much more. Head to our website to compare our accounts and features.

Check if you're eligible before applying 👀

Or we'll let you know when you sign up. At the moment you can apply for an account if you’re:

a sole trader or a registered limited company by shares (LTD),

based in the UK and

a tax resident in the UK only (if you're a limited company by shares).

Our eligibility criteria has more details about businesses and industries we can and can’t support at the moment.

Sign up straight from your phone 📱

We'll ask a few questions about your business, like what you do and how you take payments. There's no endless paperwork, trips to the bank or waiting around for a decision.

Start using Monzo Business Pro for free (usually £5 per month) 💰

If you sign up before 16 April, we'll give you one month free. We'll charge your first £5 payment one month after you open your account.

If you already have a business account with us, or you're on the waitlist, we're giving you 3 months free 🎉It's our way of saying thanks for waiting, or being with us from the very beginning.

You can cancel your account, or move between Monzo Business Pro and Monzo Business Lite any time, with no charge. And there's no minimum term on either account, so you're not locked in.

Switch to Monzo, straight from the app ⚡️

We know lots of you will already have business accounts with other banks. So after you've signed up for a Monzo Business Account, you can switch from your old bank, hassle-free. With the Current Account Switch Service, we'll move all your money and payments (like Direct Debits and standing orders) and close down your old account for you.

Our two business bank accounts are just the beginning...

Our vision now is the same as it was on day one – to build a hub for all your business finances. We want to let you see and control everything about your business, whether that's directly or through a partner. How can I send international payments? How can I stay on top of my cash flow? And how can I make sure I'm setting aside money for tax? Over the coming months, we'll start to answer those questions by giving you access to the features, services and funding that you need.