More than 5 million people across the UK use Monzo to manage their money. And we’ve been named the #1 bank in the UK for the overall quality of our service twice, by an independent survey by the Competition and Markets Authority.

We know being trusted with your money is a big responsibility, and it’s one we take seriously. So whether you’re thinking of opening a Monzo account or you’ve been with us for a while, here are a few things we do to make sure your money’s safe when you bank with us.

Your money’s protected

Because we’re a regulated bank, your money’s protected up to £85,000 by the Financial Services Compensation Scheme (FSCS).

The FSCS is an independent fund set up by the government to help protect people’s money. It covers companies that have been authorised by the UK regulators, the Financial Conduct Authority (FCA) or the Prudential Regulation Authority (PRA).

You can find out more about how FSCS protection works and look us up using the FSCS’ bank and savings protection checker.

We keep most of the money you put in your Monzo accounts in central banks, and lend out a portion of it as overdrafts and loans. Find out more about how we hold your deposits.

You can speak to a human whenever you need to

You can always speak to a human when you need to – even though we don’t have branches.

For anything urgent, you can contact us 24/7 (like if your card’s been stolen, you can’t make an urgent payment, you think you’ve been the victim of fraud, or you’re in a vulnerable position).

If your question isn’t urgent, we’ll be around to answer it between 7am and 8pm.

You’ll quickly find answers to most questions by searching our help articles.

We work hard to protect you from fraud

Signing up is simple and secure

Signing up to get a Monzo account is simple, and you can do it all from your phone. And as well as being simple, signing up is safe.

When you open a current account, your bank will check that you are who you say you are. To do that, we ask you to send us a picture of your ID and to record a short video, where we ask you to say a certain phrase. Then we make sure that what we see on your ID matches what we see in your video, which helps us confirm your identity, before we let you open an account.

Find out more about our sign-up process.

We don’t ask you for passwords

It might sound strange, but passwords don’t always make things more secure.

They can be hard for you to remember, and easy for fraudsters to guess. Most people don’t follow good password practices, and either reuse passwords or pick obvious ones (like their birthday).

Passwords can also make you more vulnerable to phishing, a type of fraud where someone tricks you into telling them your password. Plus, you can sometimes reset passwords through your email, which fraudsters can use to work around any protection provided by a password.

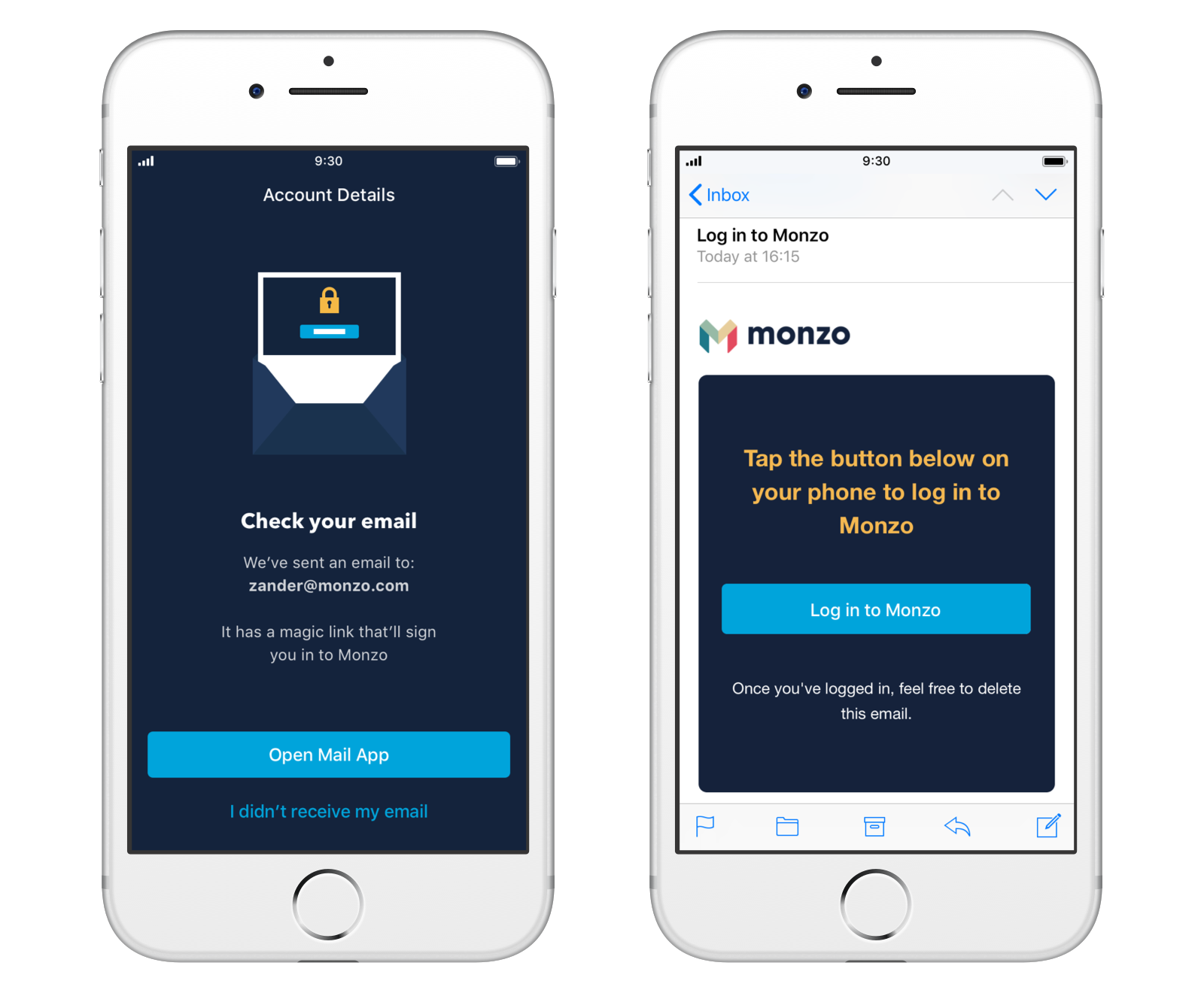

That’s why when you log into the Monzo app, we use magic links instead. They’re links we send to your email that let you log into the app in one tap. They keep your app secure, especially if you use two-factor authentication on your email.

This makes logging in quick and simple (you don’t have to remember a password or type it in accurately) and it means you’re unlikely to have your password stolen (because you don’t have one!).

For extra protection once you’ve opened your Monzo app, we confirm it's you before you can move any money.

You can only make payments once you’ve proved it’s you

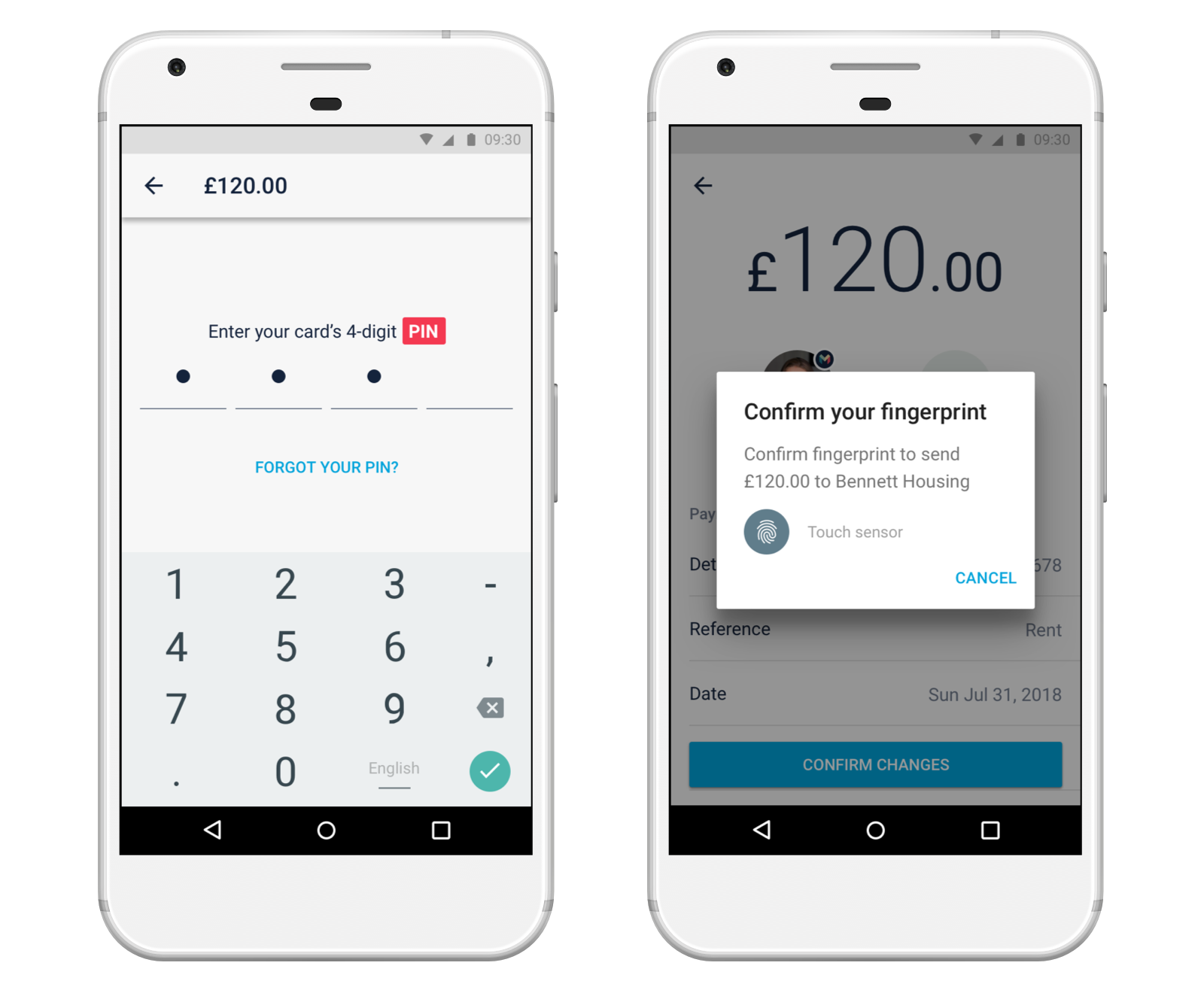

Whenever you use your Monzo account to make payments or order a new debit card, we ask you to enter your PIN or use your fingerprint or face. This protects your money with an extra layer of security.

If you forget your PIN, we’ll ask you to confirm your identity by recording another short video, before we give you a new PIN.

It’s safe to make online payments

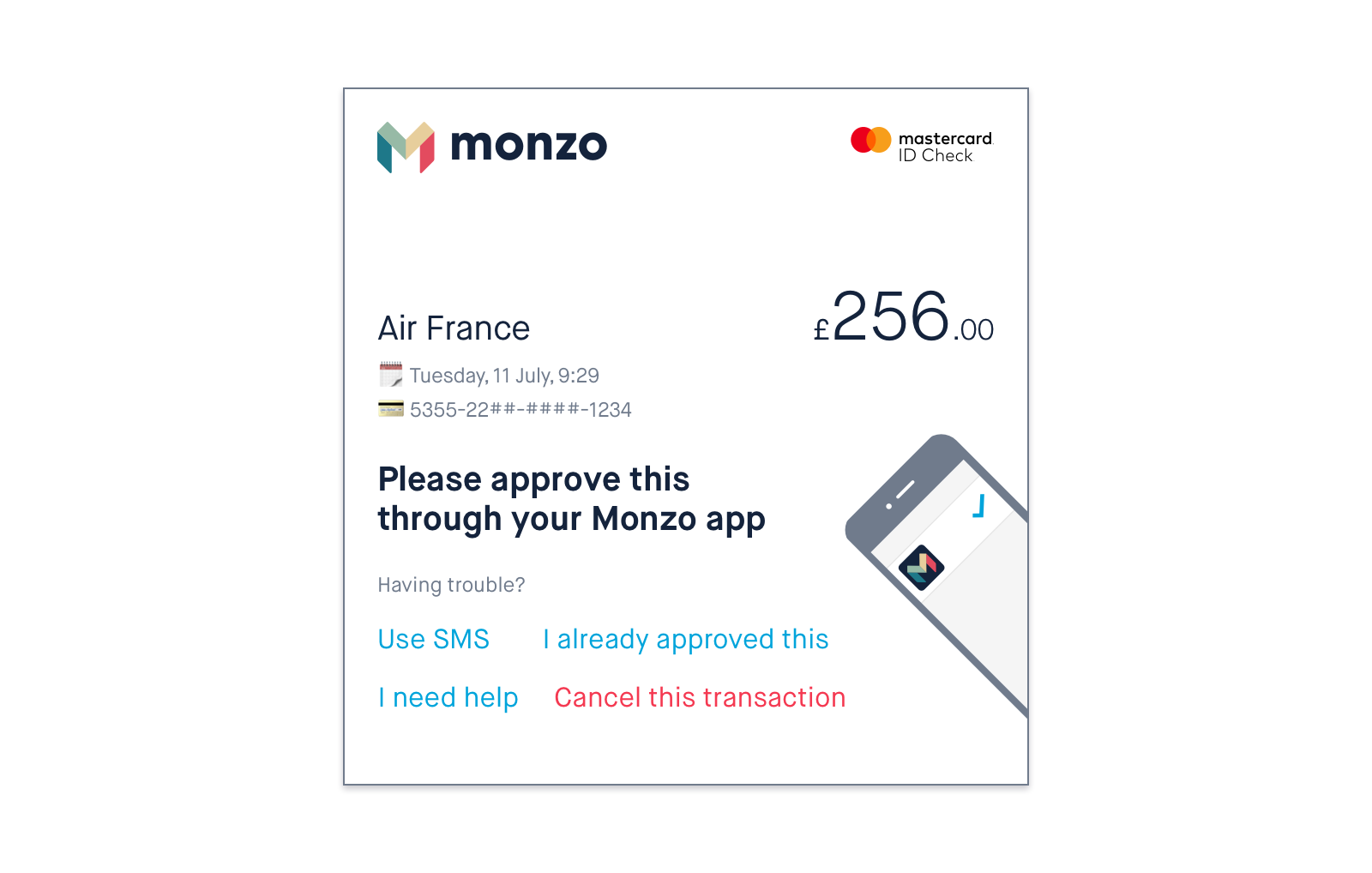

When you buy something online with most high street banks, a window usually pops up in your browser when you’re paying with your card, and asks you to enter a passcode before you can make the payment.

This is meant to make shopping online safer. But because passcodes can be annoying to keep track of, people often choose numbers that are easy to remember, which makes them easy to guess.

So when you shop online with Monzo, we don’t ask you to enter numbers from a passcode. Instead, we might get you to confirm your online purchases through the app or text instead. This lets us know you’ve got access to your phone, your app, and your card details, and confirms you’re really you.

Our team works hard to protect you

Our financial crime and security teams are made up of analysts, engineers and customer support specialists, who all work hard to protect you. Read more about our work, and how to protect yourself from the latest scams.

We have sophisticated rules that identify when transactions are unusual or suspicious, and we’re able to spot fraud quickly and take precautions to protect you.

We detected and warned Ticketmaster about a data breach months before they announced there’d been an issue. And acted quickly to replace our customers’ cards when British Airways suffered a similar breach. When Cloudflare had a security incident that affected websites and apps that use their software, we explained what happened and took steps to reduce the risk to our customers.

You can read more about how we protect you from fraud in The Guardian, the BBC, The Times and Quartz.