Monzo Plus is a current account that puts money in your hands.

It's the bank account from Monzo that helps you get a grip on your finances and make your money work harder.

Get Monzo Plus for £5 a month with a three month minimum term, if you're over 18 and open a Monzo account.

Here are 8 powerful tools and features to take your money management to the next level.

1. See your other accounts, in Monzo

Get a clear view of your finances by adding other bank accounts and credit cards to Monzo.

See your balances and transactions, and move money around using easy bank transfers.

You'll get more visibility over your money, which is crucial for budgeting better.

We encrypt the information we get from your bank, to keep it safe. You’ll renew access every 90 days and can remove an account at any time.

We use Open Banking to show your accounts, and this service is regulated by the Financial Conduct Authority.

2. Earn 1.00% AER/Gross (variable) interest on up to £2,000

Monzo Plus lets you earn 1.00% AER/Gross (variable) interest on the money in your balance and regular Pots, up to £2,000. Which we'll pay you monthly.

So you'll know your money's earning you money, even if you don't stash it away in a savings account.

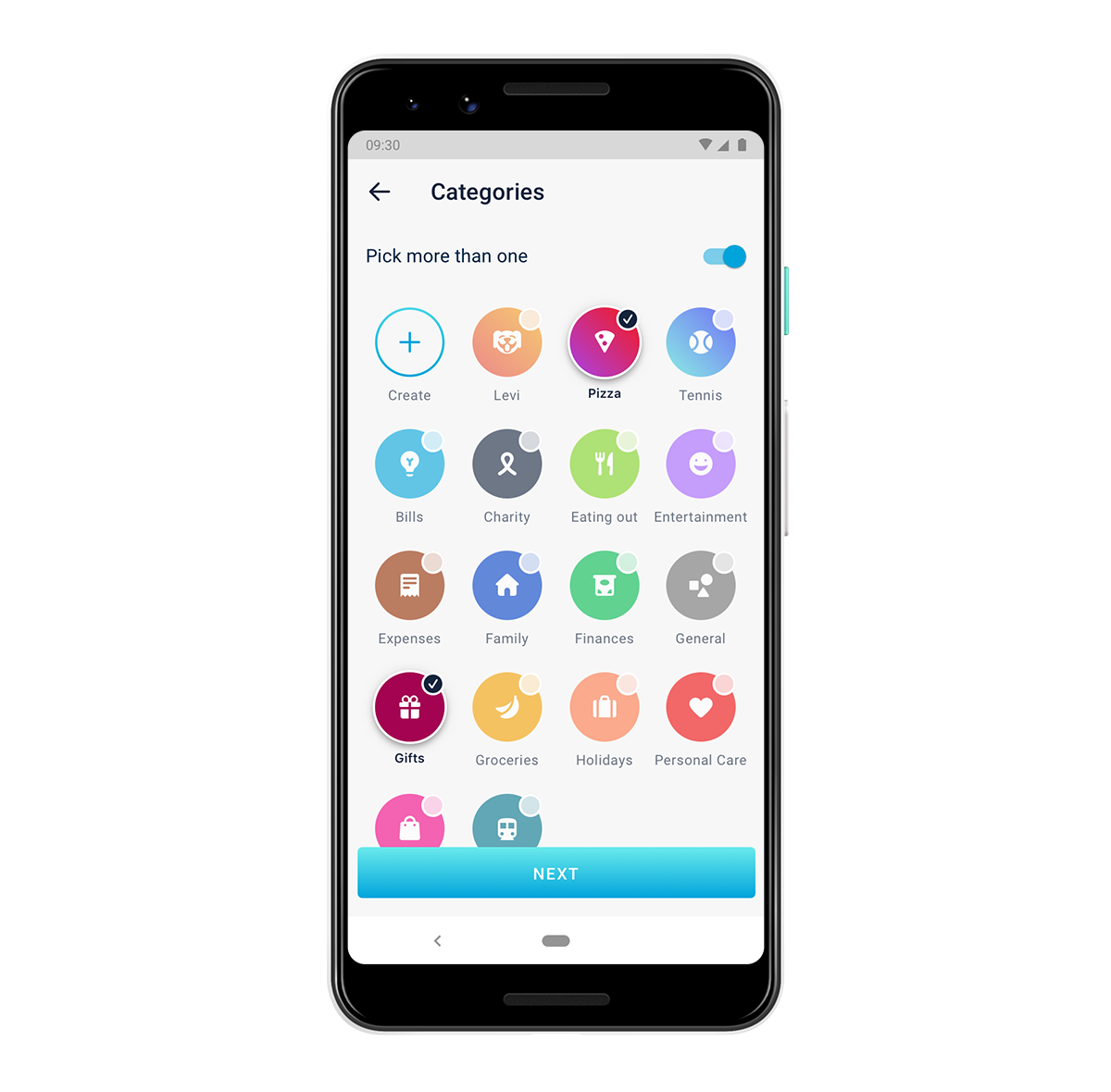

3. Budget your way with custom categories

When you spend money with Monzo, we automatically put your transaction into a category, like Shopping or Groceries.

Lots of you'd like the option to create your own categories. In fact it's one of our most-requested features!

With Monzo Plus you can create your own categories to organise your spending so it suits you.

Choose the name, icon and colour for each new category you make.

4. Divide single transactions into multiple categories

One for the budget fiends! Divide single transactions into multiple categories, to make your spending reports super accurate.

Next time you're in Lidl and get tempted by homeware, toys (or anything else you find in the middle aisle), you could split the purchase between Groceries and other categories.

5. Supercharge your savings by putting aside more spare change

With Monzo, you can round-up your spending to the nearest pound and put the spare change in a Pot. And with Monzo Plus, you can make roundups work even harder!

With advanced roundups, we times your spare change by 2, 5 or 10, to help you reach your savings goals faster.

Let's say you spend £1.90 – here's how much of your spare change we'd put in your Pot.

| Type of roundups | Spare change set aside |

|---|---|

| Roundups | 10p |

| 2x advanced roundup | 20p |

| 5x advanced roundup | 50p |

| 10x advanced roundup | £1.00 |

Great if you're working towards an ambitious goal, or simply want to set yourself a challenge 💪

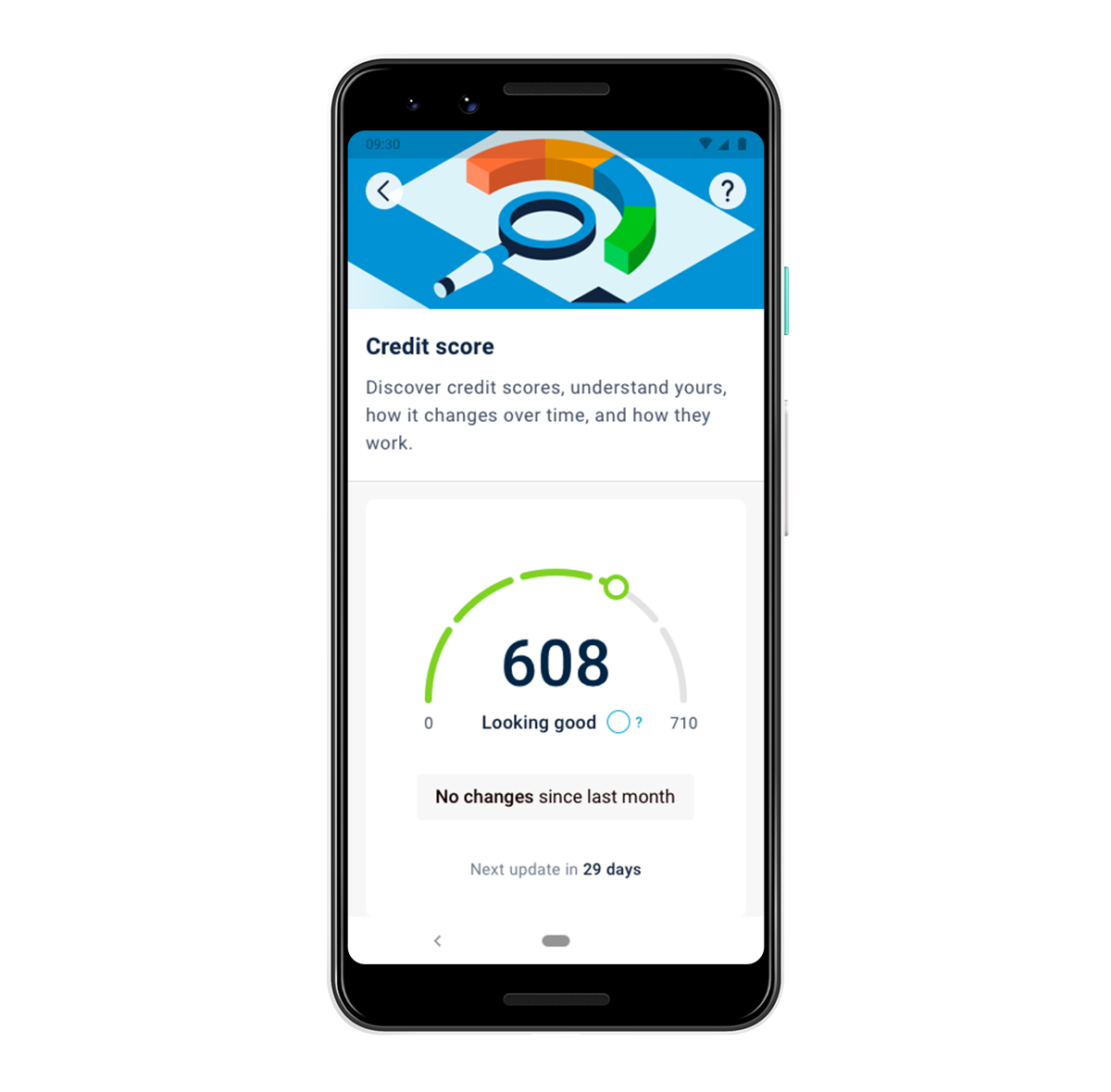

6. See your credit score and track how it changes over time

Credit scores indicate how much you can borrow, the rates you could get, and things like whether you can get a phone contract or car finance.

Some of the main things that affect your score are your history of paying back money, how much you've borrowed, and how much credit you're using.

It's important to understand what goes into your score, and how you could improve it. Because a higher credit score could give you a better chance of borrowing in the future.

With Monzo Plus, you can see your credit score in Monzo, and track how it changes over time. All in one place, with no long forms to fill in.

3 main agencies generate credit scores: TransUnion, Equifax and Experian – and they each do it differently. We're showing you TransUnion's score. We don't control it, or how they calculate it. But we'll update you on how your score changes every month, and what it could mean.

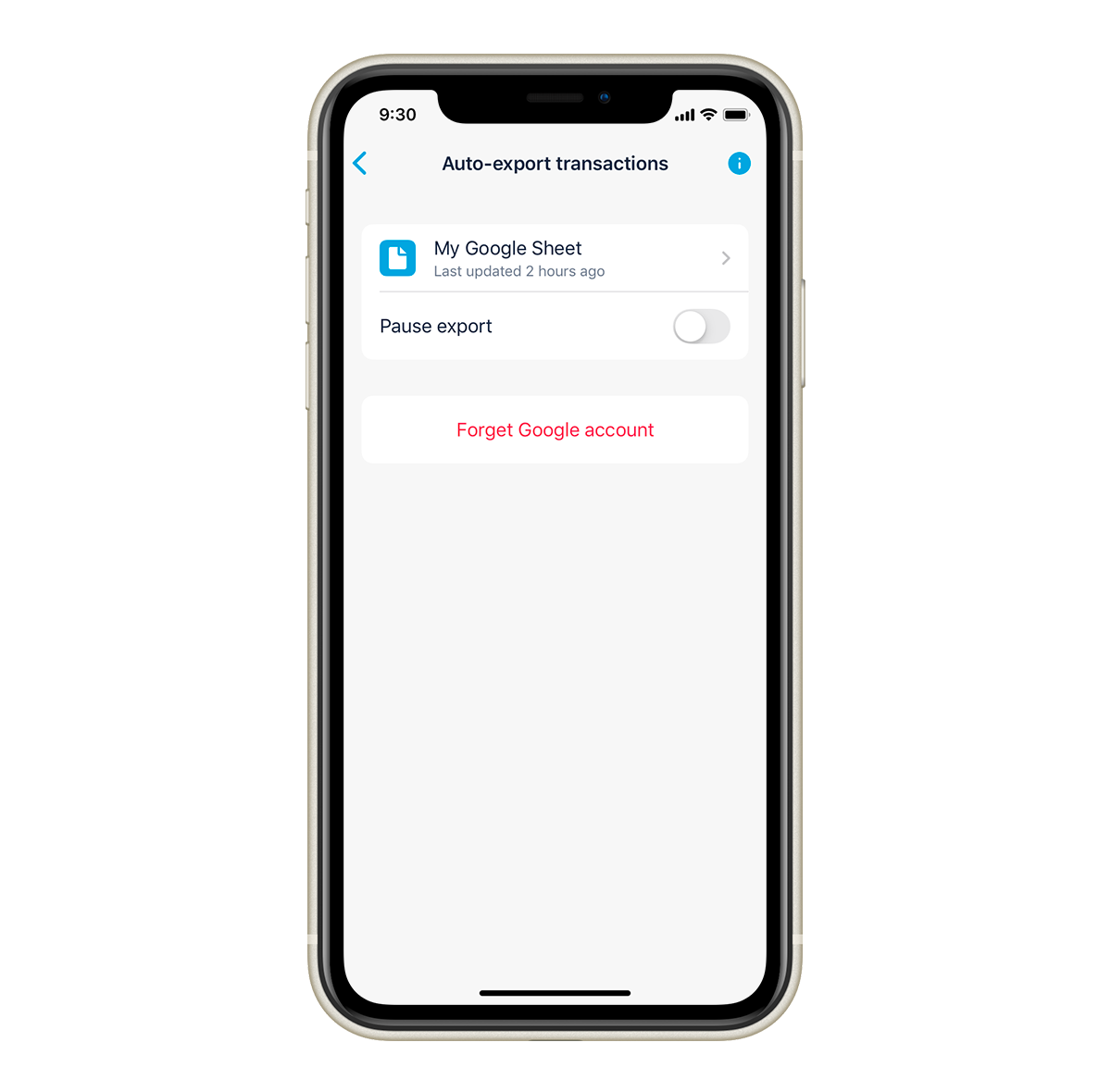

7. Automatically export your spending to a spreadsheet

Another useful feature if you're hyper-organised (or trying to be!). With Monzo Plus you can automatically export the activity on your account to a Google Sheet.

The spreadsheet updates in real time. So if you change anything in your app (like the category of a transaction), you'll immediately see the update in your spreadsheet too.

This is handy if you use spreadsheets to track or analyse your money. Or you might just want to keep a record.

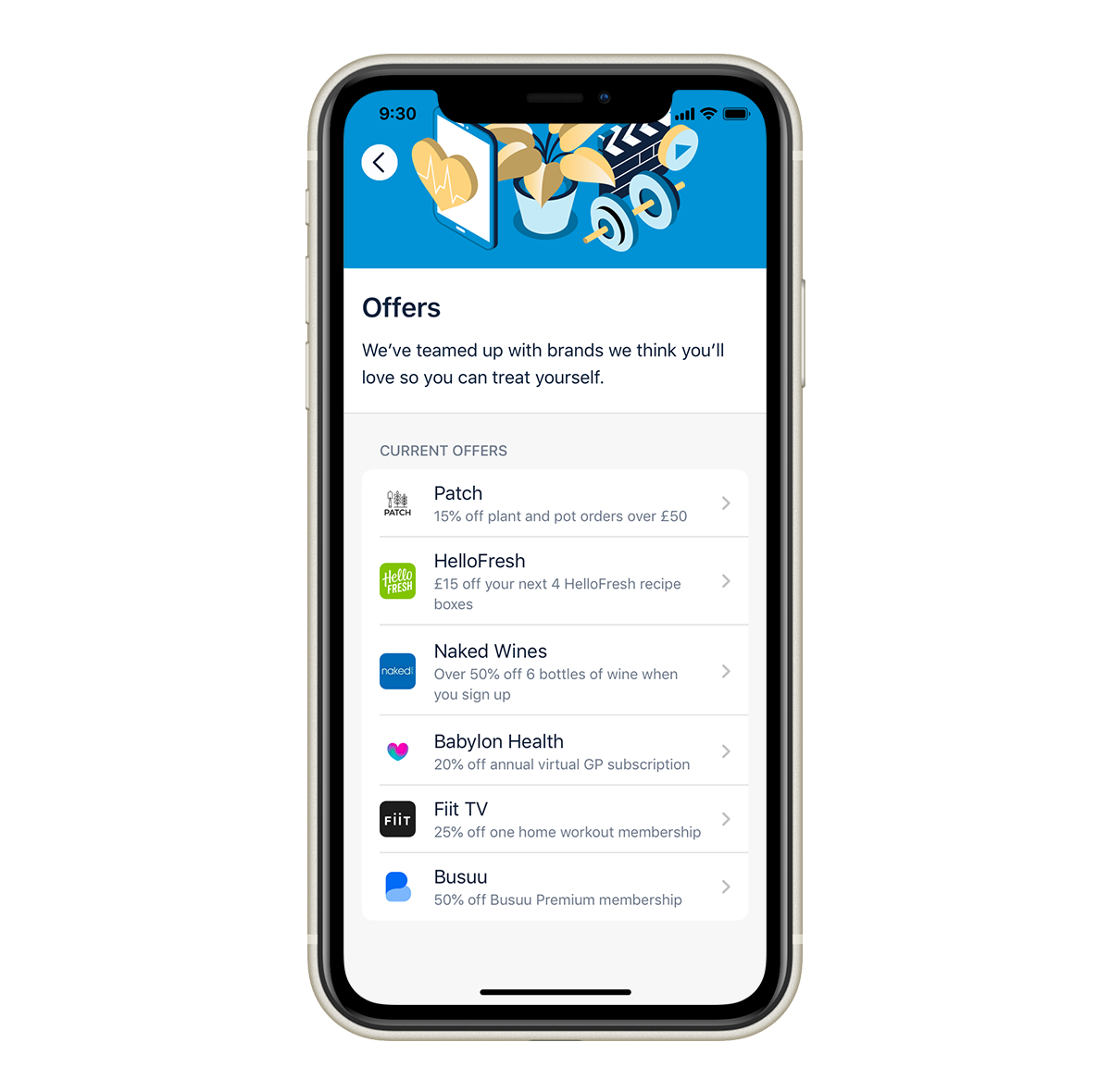

8. Treat yourself with offers from brands you'll love

Sticking to a budget and focusing on your savings goals doesn't mean you can't have fun.

With Monzo Plus you can treat yourself to offers from brands we think you'll love.

Right now those offers are:

Patch

15% off all plant and plant pot orders over £50.

HelloFresh

£15 off each of your first 4 HelloFresh recipe boxes when you sign up.

Naked Wines

£24.99 for 6 top-rated bottles of wine (including delivery) when you sign up to a Naked Wines Angel subscription as a new customer.

Babylon Health

20% off an annual virtual GP subscription and free access to the COVID-19 Care Assistant.

Fiit

25% off one home workout membership.

Busuu

50% off a Premium or Premium Plus plan of language lessons.

Get Monzo Plus

To get a grip on your finances and stretch pennies into pounds, get Monzo Plus today!

Get Monzo Plus for £5 a month with a three month minimum term, if you're over 18 and open a Monzo account. You'll get these powerful tools and features, with a holographic card exclusive to Monzo Plus.