Today we're launching Monzo Premium, our newest account. It's banking that makes a statement, and it comes with our first metal card.

Get extensive phone insurance for phones worth up to £2,000, and worldwide travel insurance for you and your partner or family. As well as 1.50%/1.49% AER/Gross (variable) interest on up to £2,000 in your balance and regular Pots, and much, much more.

All for just £15 a month, with a 6 month minimum term. (You have to be aged 18–69 to sign up for Monzo Premium.)

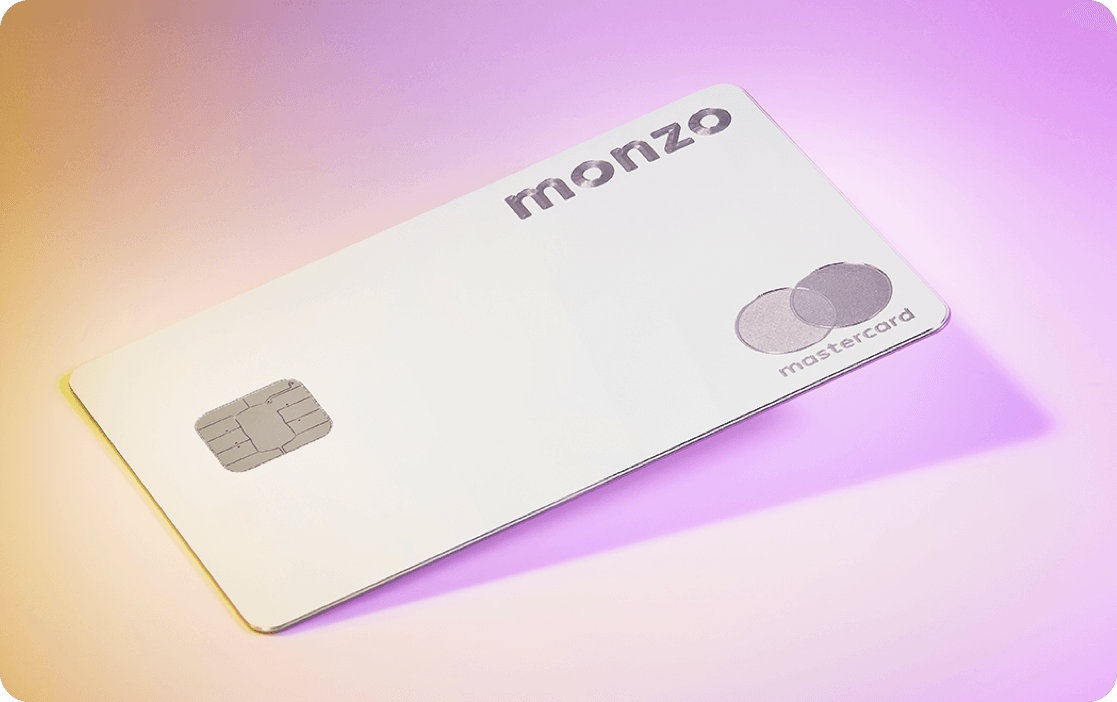

Say hello to metal

Your Monzo Premium card is made from a single 16g sheet of steel, complete with a precision-engraved logo and a white finish. With your details kept neatly on the back for a minimal design. It’s available right now, and it’s exclusive to Monzo Premium.

Phone insurance, from Assurant

Worth an average of £97 a year. More on this below.

We’ve all been there, right? That heart-in-your-mouth moment where you reach down to flip over the phone you dropped to the concrete. It’s a feeling we’d all rather avoid, and knowing your phone’s insured can really put your mind at ease.

With Monzo Premium, phones worth up to £2,000 are protected against theft, loss and accidental damage – even the dreaded cracked screen.

Any accessories under £300 are covered too, like headphones, chargers or cases. If you had to make a claim, you’d pay the first £75 – this is what’s called the excess.

Read the Assurant terms and conditions for exclusions and full details. There’s also the Assurant Insurance Product Information Document (IPID) for a summary of the benefits, exclusions and other important information.

Worldwide family travel insurance, from AXA

Worth an average of £159 a year. More on this below.

We could all do with some added comfort and security when it comes to travel plans right now. With Monzo Premium, you get AXA travel insurance that covers you and your family (including partners and dependent children up to 21 years old), anywhere in the world.

It covers medical bills up to £10 million, lost valuables up to £750, and cancellation costs up to £5,000. As well as flight delays of more than 4 hours and winter sports, including skiing and snowboarding.

And if you had to make a claim, you’d pay the first £50 – again, that’s the excess.

As with any insurance policy, you should have a good look at the terms and conditions to make sure Monzo Premium and its AXA cover are right for you. There’s also the AXA Insurance Product Information Document (IPID) for a summary of the benefits, exclusions and other important information.

🔴 Important: Coronavirus and your AXA travel insurance

When the World Health Organisation declared coronavirus a pandemic it became a ‘known event’. Which is an insurance term that affects what you can and can’t claim for.

See our dedicated coronavirus webpage for up to date information on what your AXA travel insurance covers. We've listed everything on that page – not in this post – so we have one source of truth. That way we avoid having outdated information lying around online.

Earn 1.50%/1.49% AER/Gross (variable) interest on up to £2,000

You'll earn interest on up to £2,000 in your balance and regular Pots (not including Savings Pots). Which means your money earns you money, simply by sitting in your account.

£600 fee-free cash abroad every 30 days

Take out triple the amount of fee-free cash that you can take out with our original Monzo account. And £200 more than you get with Monzo Plus. Perfect for when we’re all moving freely again.

You can take out more than £600 in a 30-day period, but we’ll charge 3% on however much you withdraw after that.

All this and more

Here’s what else you get, on top of the features we just told you about.

🍸 Discounted airport lounge access, from LoungeKey – Access for you and whoever you’re travelling with to over 1,100 airport lounges worldwide, at £24 per person, per visit. All with social distancing measures in place for your safety.

🔗 See your Amex and other bank accounts, in Monzo – Get a clear view of your finances by adding your other bank accounts and credit cards to Monzo. See your balances and transactions, and move money around with easy bank transfers. Make sure to read the terms and conditions before you add an account.

👀 Credit Tracker – See your TransUnion credit score and track how it changes each month. With helpful information about what a credit score is and how to improve yours.

💸 Custom spending categories – Create your own categories to break down your spending, your way. Plus, divide single payments into multiple categories, like separating your supermarket purchase into food and wine.

💳 Virtual cards – We’re all spending more online these days, so it’s important to protect yourself. Keep your physical card details safe by using virtual cards for online payments. The money you spend comes from your balance, just like with your physical Monzo card. It's especially handy for managing online subscriptions.

🛍 Offers – From brands we think you'll love. Like 15% off Patch plant and plant pot orders over £50. As well as 25% off a Fiit home workout membership and 20% off an annual subscription to Babylon Health. These may change over time, and again – make sure to read the terms and conditions before claiming an offer.

🧾 Auto-export transactions – If you want us to, we'll add your transactions to a single Google Sheet as they happen, so you can get to know your money better. You can then add your own tables and graphs. And if you change your mind, you can turn auto-export off whenever you like.

💰 Advanced roundups – Put 2, 5 or 10 times as much spare change aside every time you spend to reach your savings goals faster. Whatever you buy, we round up the payment to the nearest pound and put the spare change in a Pot. With advanced roundups, we times the spare change by 2, 5 or 10.

🏦 5 free cash deposits a month – Pay in cash 5 times a month, for free. Just go to one of the 27,000 PayPoints across the UK to pay your money in. If you pay in cash more than 5 times a month, we’ll take our normal £1 fee from the money you pay in.

Plus, everything you get with our free account

You get all of this, as well as everything you get with our free, original Monzo account.

Things like fee-free UK bank transfers, Pots for separating your money, instant spending notifications, customer support when you need it and more. And protection for your money, as your eligible deposits in Monzo are protected by The Financial Services Compensation Scheme (FSCS) up to a value of £85,000 per person.

The insurance policies alone are worth an average of £256 a year

How did we get this valuation? We asked independent market research group Consumer Intelligence to see what it would cost if you bought these insurances policies on their own.

The results showed that the two policies are worth an average of £256 a year, and up to £343 a year (depending on the provider). And that’s for just two of the features you get with the account. For reference, at £15 a month, Monzo Premium with all its features costs £180 a year.

Read our blog post on this for more detail.

Get Monzo Premium today

You need to be aged 18 to 69 and have the latest version of Monzo on your phone to sign up for Monzo Premium. Anyone who has a Monzo or Monzo Plus account can upgrade to Monzo Premium in minutes, if you’re eligible. Take a look at the terms and conditions for full details.

If you’ve had our newest version of Monzo Plus for less than 3 months, you can sign up to Monzo Premium without paying the Monzo Plus early cancellation fee.

And if you’re completely new to Monzo, download the app here.