Earlier this year, we launched our Monzo Business accounts to the public. And almost exactly 6 months on, we've reached 50,000 business customers! 🎉

We're grateful to each and everyone of you for coming with us on our journey to build the best bank account for small businesses. We've had countless messages of support, feedback and ideas on how we can make business banking even better.

And we're really proud of our small business community. They come in all shapes and sizes:

55% of our businesses are sole traders, and 45% are limited companies. And they range from videographers to Etsy sellers, bakers, tech startups, digital consultants and everything in between!

Our youngest businesses just started out during lockdown, and our oldest businesses are over 15 years old

We serve businesses in all the nations and regions of the UK - with 70% of our customers located outside Greater London, and 58% outside Southeast England

Monzo Business has come a long way in 6 months too! Here are just a few of our highlights - plus what we're excited about next.

1. Supporting small businesses through coronavirus

The coronavirus pandemic meant it wasn't the 6 months any of us expected - including you, our small business community. We heard from many of you that you weren't sure where to turn and what support was available to you.

So, we created a coronavirus support hub with guidance on how to access government support, securing your finances, moving your business online and looking after your mental health.

And we're not stopping there! We're writing even more guides to help you with the other elements of managing your business, too - like understanding cashflow and using social media. And we've recently launched a new series on our Monzo Business Twitter and Instagram accounts, putting the spotlight on you, our amazing business customers, and letting you hear from them directly.

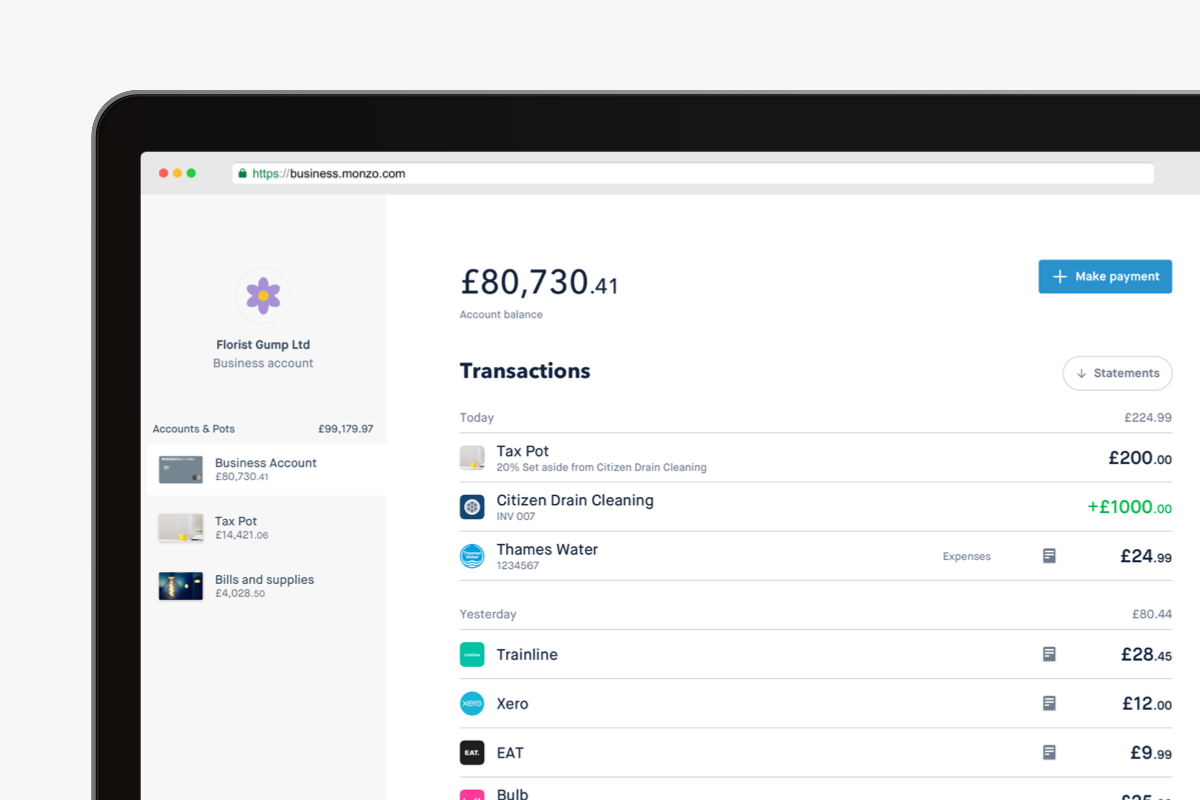

2. We made Monzo Business on the Web even better

When we launched earlier this year, we also let you access and manage your business account from the convenience of your desktop. You told us that you'd often do a lot of your business admin from a desktop, so having access to Monzo Business from a desktop made sense.

We've continued improving the Web, so you can do even more, including:

Seeing your Pots, including any Pot images

Moving money to and from a Pot

Export your transactions as a PDF, CSV or QIF, with custom date ranges. You'll also be able to download any receipts you've attached to your transactions.

...and lots of little stuff to make using the Web even slicker!

To manage your Monzo Business account on a desktop, go to business.monzo.com.

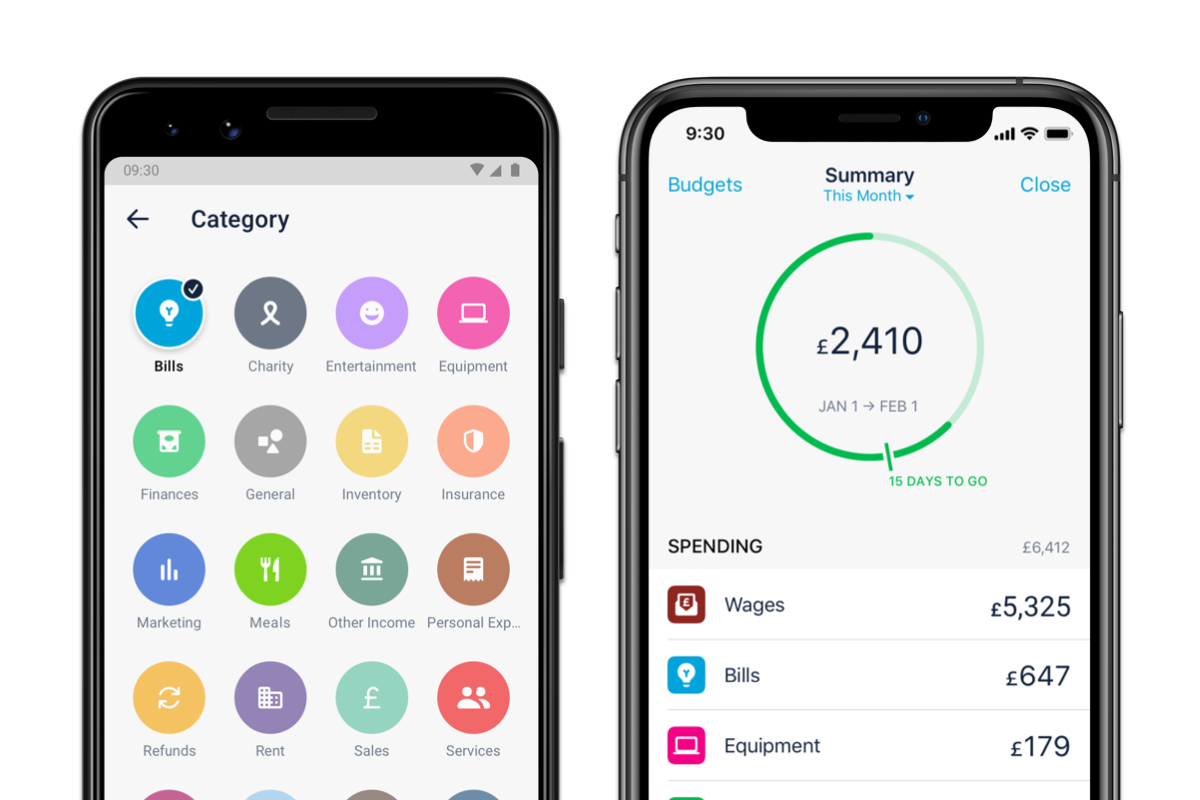

3. We added new income and spending categories, for better budgeting

We added 14 new income and spending categories, especially for business. We designed them to give you even more visibility and clarity over where you're spending and receiving money from - and help you budget better.

They include brand new income categories, like Sales and Services.

And we added new spending categories that covered more allowable expenses, like Wages, Inventory, Supplies, Tax and Equipment.

And you can see these categories when viewing your account on the web, too!

4. We launched a special offer with Google Ads and Jellyfish, to help you start advertising

Getting in front of your target customers is more important than ever. So we teamed up with Google Ads and JellyFish to get Monzo Business Pro customers an exclusive offer when you start advertising online: for every £1 you spend with them in your first two months, you'll get another £1 of credit back the next month, up to £120.

And that's not all! We love teaming up with other companies who support small businesses, to bring you exclusive offers that make managing your business even easier. If you're a Business Pro customer, you'll have access to exclusive offers - including Xero, Square and Expensify - straight from your app. Just tap your profile picture in the top left corner, and then Offers for your business.

Looking ahead

We’re building Monzo Business because we believe business banking can be better - and our journey is just starting. Our vision now is the same as it was at day one – to be the centre of your business finances. To give you helpful insights and tools that automate your painful admin, so you can spend more time doing what matters most: running your business.

You don't have to worry about not having enough money to cover your tax bill, because we’ll help you save automatically with Tax Pots. And soon, you won't have to chase customers for late payments because we’ll do it for you (or send you reminders, if you’d rather do it yourself). And you'll never have to panic that you can’t pay your bills, because we’ll always give you plenty of notice if you’re running short - and even help you find funding if you need it.

Over the last 6 months, we’ve heard hundreds of stories from our business community about how Monzo Business has given them peace of mind and made their lives better. But we’re not stopping there. Soon, we’re excited to take even more steps toward our vision. We’ll give you more ways to pay and get paid, help you get a quick oversight of your cashflow, and give you even more control over your spending.

If you’d like to follow along on our progress toward this vision, check out our transparent product roadmap. You can see exactly what we’re working on, what’s coming next and vote on your favourites. And don't forget to follow us on Twitter and Instagram to stay up to date, and hear from our business community!

Monzo Business accounts help you manage your business finances stress-free. Know when you’ve been paid immediately with instant notifications, and and choose a percentage to save for your taxes automatically with Tax Pots.