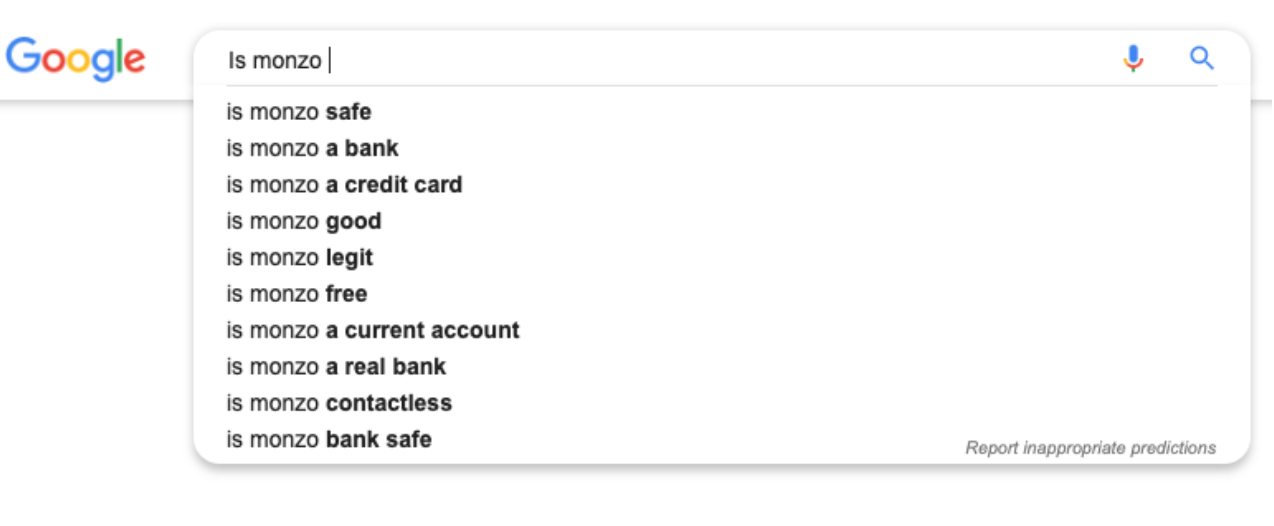

We took to Google to find out what Monzo-related questions you’ve been searching the internet for. You asked, and now we’ve answered 😉

What is Monzo…

What is Monzo Bank? What is Monzo app?

Monzo is a bank, that lives in an app. It helps you budget better, takes the stress out of spending abroad, and even lets you earn interest on your savings. And even though it’s an app, you can get help from real humans, whenever you need it.

We’ve been a fully-fledged bank since we received our banking licence in April 2017. And like all other banks in the UK, that means we’re authorised by the Prudential Regulation Authority (PRA) and regulated by the PRA and the Financial Conduct Authority (FCA).

You can use Monzo to do the basic things you’d expect from your traditional bank, as well as much, much more.

What is Monzo Plus?

Monzo Plus is a way for you to add extra features to your Monzo account, from £3 a month.

It lets you add features like travel insurance or exclusive rewards to your Monzo account.

It’s still a work in progress, but we’re working to add more features based on your feedback. Read more about our plans for Monzo Plus and join the waitlist!

What’s the Monzo sort code?

Your Monzo account is a full UK bank account, so it comes with an account number and sort code.

The Monzo sort code is 04-00-04.

And you can find your account number in the Profile screen in your app. Just head to the Account tab and tap on your name 😊

What’s the Monzo IBAN?

To receive international payments into your Monzo account, you need an IBAN.

An IBAN is a unique identifier that’s used to distinguish your bank account from all the others around the world. It’s a combination of your account number, sort code, and your bank’s Bank Identifier Code (BIC).

You can use an online IBAN generator to generate an IBAN. Then, to try and receive a payment, either:

Share this IBAN with the person who needs to pay you

Or if you’re sending money to yourself, make a bank transfer or set up a Direct Debit to your Monzo account by entering that IBAN

You can try to make or receive payments this way in any currency, but unfortunately they aren’t very reliable yet. Payments will either take a few days to go through, or return to the original sender after a few days. And we might not be able to help track down any missing payments.

Here’s more information on using Monzo for international payments.

What’s a Monzo Golden Ticket?

Monzo Golden Tickets are the perfect way to invite your friends to Monzo. They’re a special link you can share to help them open a Monzo account easily.

If you use Monzo, you can share Golden Tickets with your friends! Just open your app and head to the Payments tab. You’ll see the option to invite friends there 🎫

What is Monzo.me?

Monzo.me is a special link that makes it easy to pay people with Monzo, or request money from your friends.

You can also use Monzo to make regular bank transfers, and pay your contacts on Monzo in just a few taps. You can split bills easily, keep track of ongoing expenses, and pay absolutely anyone, just with a link (even if they don’t have Monzo).

To pay anyone or request money from friends, just open your Monzo app and head to the Payments tab. You’ll see all the options to pay and get paid there!

What is Monzo worth?

Monzo is valued at £2 billion. Find out more here.

How to use Monzo…

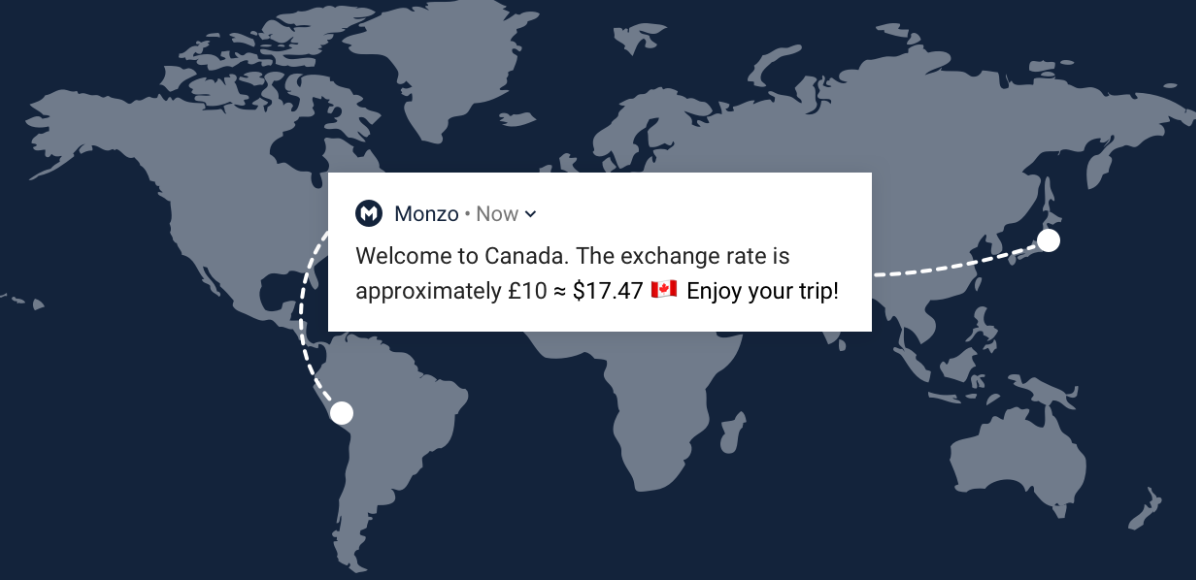

How to use Monzo abroad…

You can use your Monzo card anywhere in the world, for free. You don’t need to tell us in advance and we don’t add any fees to the exchange rate. We just pass Mastercard’s exchange rate directly on to you. Just remember to pay in the local currency!

While you’re abroad you can withdraw up to £200 every 30 days for free. If you’ve used your free allowance, there’s a 3% charge on withdrawals after that.

How to use Monzo Pots…

Monzo Pots are a simple way to set money aside within your main Monzo account! 🍯

You can set up multiple Pots for different purposes, and see an overview of all your money in the Account tab in your app.

To start using Pots:

Head to the Account tab in your app

Tap the option to Create a Pot

Give it a name and add an image. You can even set a goal for how much you want to save. Or lock your Pot to stop yourself dipping into it!

Put some money in straight away (or wait till payday if you like 😉)

Because you’ve set it aside for saving, you won’t see money in your Pots in your available balance, and you won’t be able to spend it. But you always can move money back into your main account.

You can even use Pots to earn interest on your savings! You’ll see the option to create a Savings Pot when you create a new Pot. We’ve made it really easy for you to open and move money into a Savings Pot that earns interest, without needing to go through the painful admin that comes with opening a new savings account elsewhere.

Read more about Saving Pots here!

How to use a Monzo overdraft…

Overdrafts with Monzo are totally optional. If you decide to use an arranged overdraft, we’ll charge you an EAR of 19%, 29% or 39% (variable).

As a representative example, if you use an arranged overdraft of £1,200 for 30 days, with 19% EAR/APR (variable), it would cost you £17.28. Your exact rate will depend on your credit score, and you can see what rate you’re on in your Monzo app.

Your rate will depend on your credit score, and we’ll always tell you the exact rate you’ll pay, and what that means in pounds, before you borrow from us.

EAR stands for effective annual rate. This is equivalent to the rate of interest you'll pay if you're overdrawn for a year. You'll pay interest on the amount you're overdrawn by, and on the interest that builds up from being overdrawn. So you'll pay less if you regularly pay off your overdraft. EAR doesn’t include other fees, like hidden or late fees – but we don’t charge these anyway.

Variable means we have the right to change the rate, but we’ll always give you notice if we do.

Head to the Account screen in your app to find out if you’re eligible for a Monzo overdraft. Or head to our overdrafts page for more.

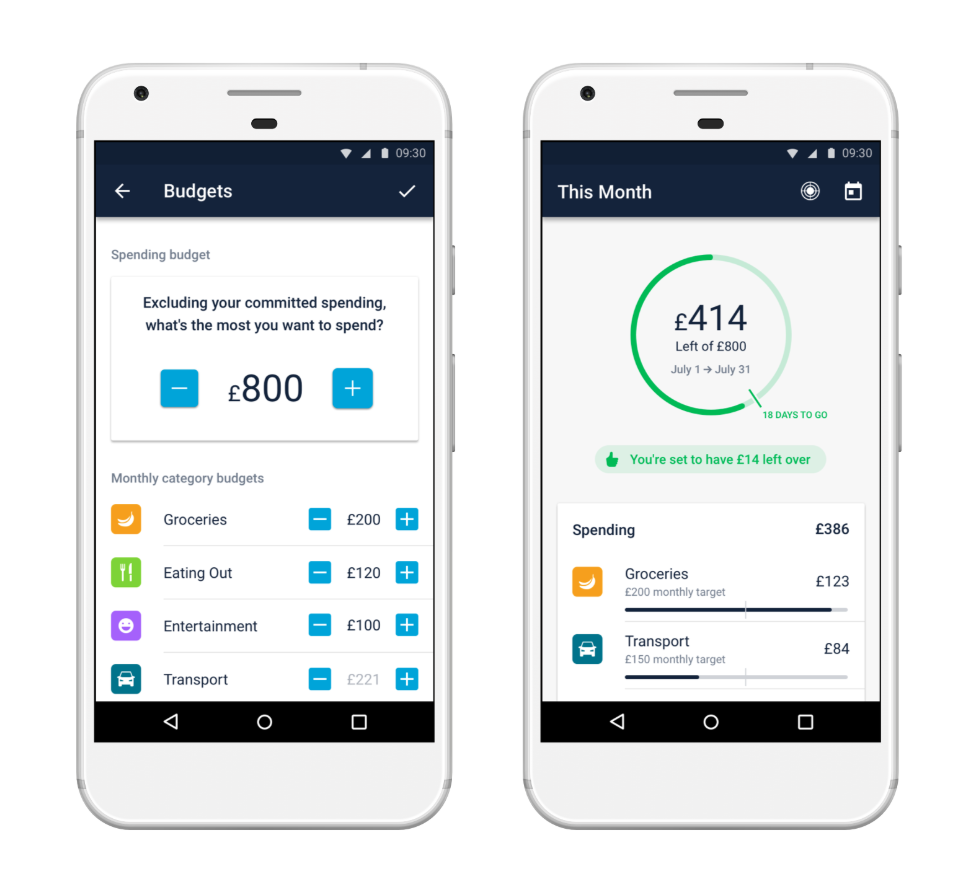

How to use Monzo to budget…

Having a budget is one of the most important things you can do to improve your financial life.

Monzo helps you budget by keeping track of different kinds of spending. Whenever you buy something with Monzo, we automatically put your payment into a category, like ‘Transport’ or ‘Groceries’. Then, in the Summary tab in your app, you can see what you’ve spent on each category this month.

You can set a monthly spending budget. Then as you spend, we’ll let you know how close you’re getting to your limits, and give you gentle reminders to stay on track.

You can also use Pots to set money aside, away from your main balance. Try putting money you need for bills into a Pot as soon as you get paid, and only moving it back into your account when you need it.

Read our full guide to budgeting with Monzo.

How to use Monzo with Google Pay…

You can add your Monzo card to Google Pay if you’ve got a compatible Android phone.

Here’s how you can do it:

Download the Google Pay app from the Google Play Store

Follow the Google Pay app’s instructions to add your Monzo card

They’ll send you a code via text to check your account, which you’ll need to enter

That’s it!

How to use Monzo in the USA…

You can use Monzo in the USA (and anywhere else in the world!) You don’t need to tell us in advance and we don’t add any fees to the exchange rate. We just pass Mastercard’s exchange rate directly on to you. Just remember to pay in the local currency!

While you’re abroad, it's free to withdraw from ATMs in the European Economic Area (EEA). For other countries, you can withdraw up to £200 every 30 days for free. If you’ve used your free allowance, there’s a 3% charge on withdrawals after that.

In the UK, almost all ATMs use Chip and PIN to validate your identity when you try to withdraw money. But in America (and lots of other countries), ATMs use the magnetic stripe on the back of your card to dispense cash.

We normally disable magstripe ATM withdrawals to protect against fraud. But when you’re in the USA, you’ll need to turn on the ability to withdraw cash from magstripe ATMs from Settings in your app.

Contactless card payments also aren’t as common in the USA, so you might have to insert your card to make payments more often than usual.

Our community have crowdsourced more Information about using Monzo in the USA. So if you have any other tips, post them there for others to see!

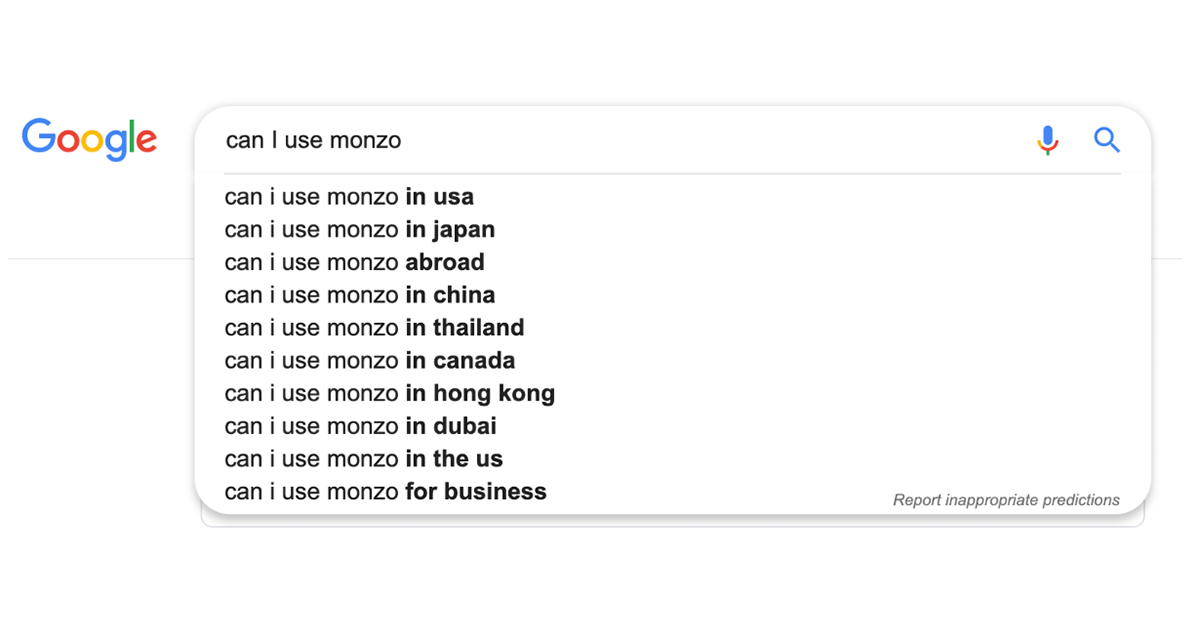

Can I use Monzo…

Can I use Monzo in the USA? Can I use Monzo in Japan? Can I use Monzo in China? Can I use Monzo in Thailand? Can I use Monzo in Canada? Can I use Monzo in Hong Kong?

You can use Monzo anywhere that accepts Mastercard. So you’ll be able to use your Monzo card wherever in the world you’re travelling!

You don’t need to tell us in advance and we don’t add any fees to the exchange rate. We just pass Mastercard’s exchange rate directly on to you. Just remember to pay in the local currency!

While you’re abroad you can withdraw up to £200 every 30 days for free. If you’ve used your free allowance, there’s a 3% charge on withdrawals after that.

Our community have crowdsourced wiki about how to use Monzo in specific countries. So definitely search for your destination before travelling!

Can I use Monzo for business?

Yes you can! We launched our business bank accounts in March 2020.

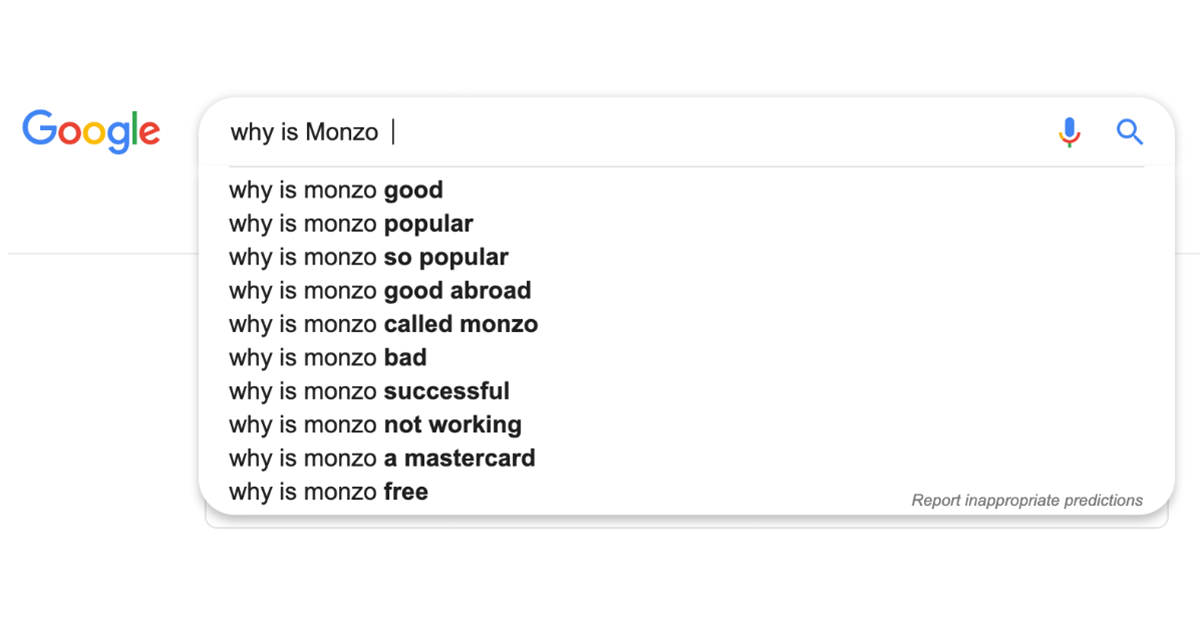

Why is Monzo…

Why is Monzo good?

There are plenty of good things about Monzo, depending on what you’re looking for. It helps you budget. Makes travel easy. Lets you earn interest on your savings. And you can get help from real humans, whenever you need it.

To answer this question properly, we’ve put together 11 reasons you should definitely get Monzo.

Why is Monzo good abroad?

Monzo is useful abroad because you don’t need to tell us before you go, and we don’t add any fees to the exchange rate. We pass Mastercard’s exchange ratedirectly on to you, and don’t add fees or additional charges.

While you’re abroad you can withdraw up to £200 every 30 days for free. If you’ve used your free allowance, there’s a 3% charge on withdrawals after that.

At the end of your trip, we’ll even send you a summary of exactly how much you spent while you were away!

Why is Monzo called Monzo?

We started life back in 2015 as “Mondo”. But that name was legally challenged by another company with a similar name. So we turned to our community and asked you to help us come up with a new one!

More than 10,000 of you sent us 12,560 suggestions for our new name. And so Mondo became Monzo!

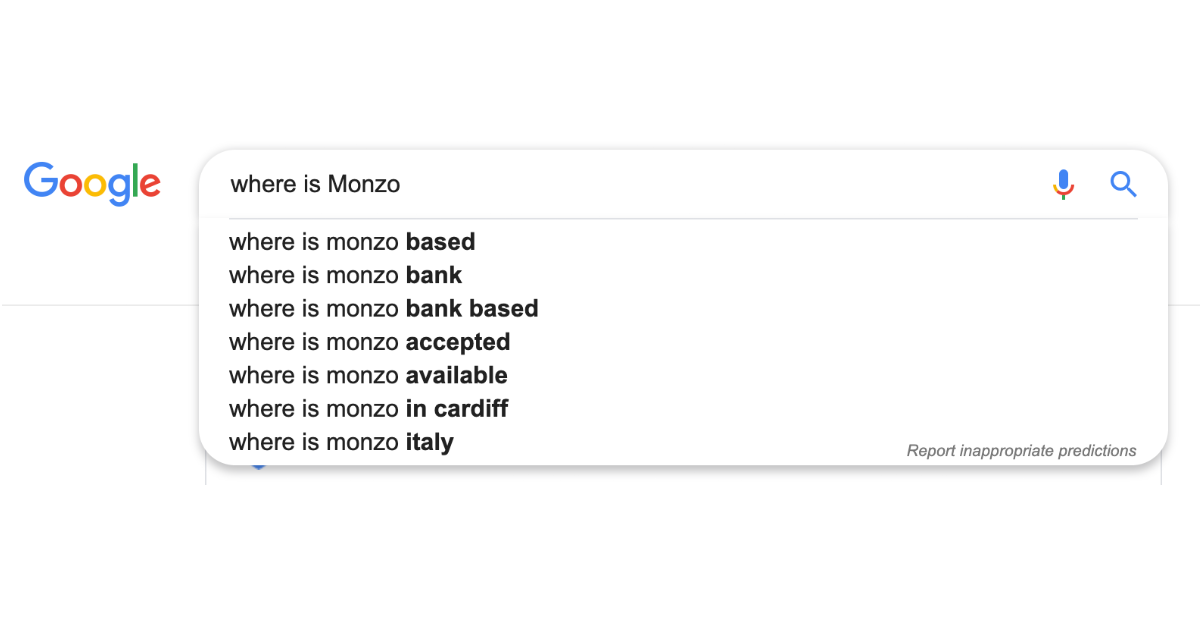

Where is Monzo…

Where is Monzo based?

Monzo is an app that exists on your phone. So we go wherever you do!

Our headquarters are in London, but we have hundreds of people working in Cardiff, Las Vegas and remotely around the world! Solving your problems and making Monzo better every day.

Where is Monzo available?

Monzo is available in the UK. We have now also officially launched in the US! You can join the waitlist for the US version of Monzo here.

Where is Monzo accepted?

Your card should be accepted anywhere that Mastercard is, in the UK and around the world!

Some merchants don’t keep their systems up to date, so we occasionally see situations where our cards aren’t recognised. We have a team dedicated towards resolving issues like this, so please let us know if you have problems!

We do find some occasional issues in countries like Cuba, Portugal, North and South Korea, and Bulgaria.

Our community forum and the Help tab in your app are the best places to ask questions about using Monzo in specific places.

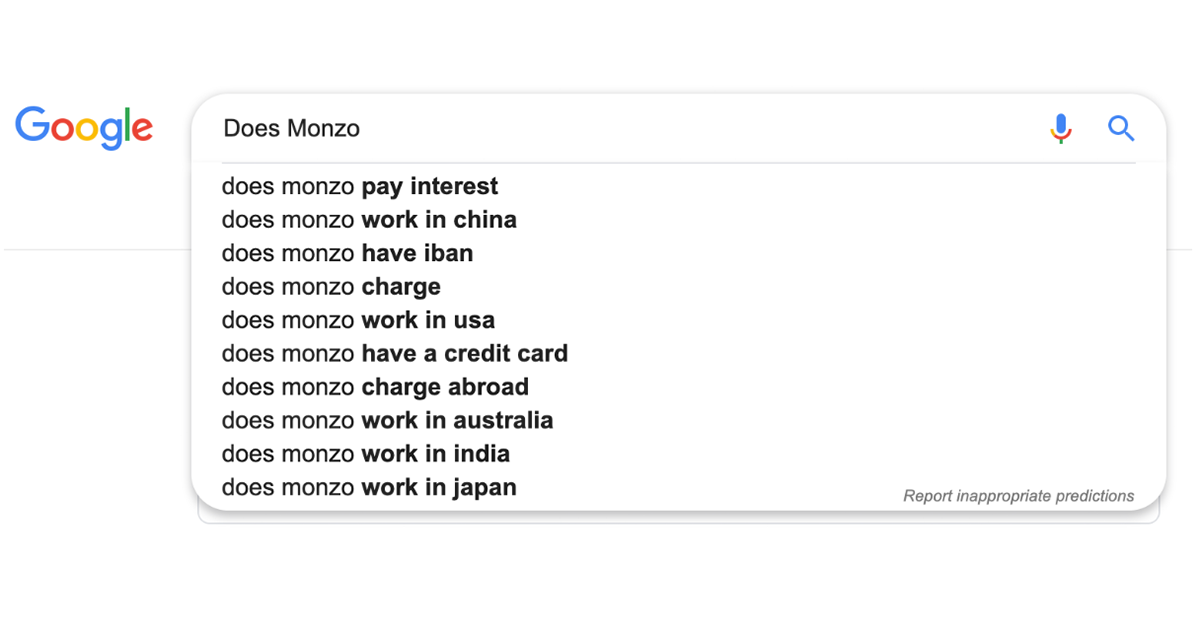

Does Monzo…

Does Monzo pay interest?

You can earn interest on your savings through Monzo with Savings Pots!

They’re set up to help you access competitive interest rates in a simple, transparent way. We’ve teamed up with other banks to make it easy for you to open and move money into a Savings Pot that earns interest, without needing to go through the painful admin that comes with opening a new savings account elsewhere.

Here’s more information on how to earn interest on your savings through Monzo.

Does Monzo charge?

Opening a Monzo account and using it day-to-day is completely free!

If you have an overdraft, we’ll charge you when you use it. And we also charge if you withdraw more than £200 of cash a month when you’re abroad.

Does Monzo have a credit card?

Nope, Monzo is a debit card.

If you’re considering getting a credit card, make sure you consider the pros and cons.

Is Monzo…

Is Monzo safe?

We know being trusted with your money is a big responsibility, and it’s one we take seriously.

Because Monzo is a regulated bank in the UK, the money you put in your Monzo account is protected up to £85,000 by the Financial Services Compensation Scheme (FSCS). The FSCS is an independent fund set up by the government to help protect people’s money. If Monzo (or any other bank or building society) goes bust, it means you won’t be left out of pocket.

Find out more about how we make sure your money’s protected.

Is Monzo a bank?

Yes! Monzo is a bank, that lives in an app. We’ve been a fully-fledged bank since we received our banking licence in April 2017. And like all other banks in the UK, that means we’re authorised by the Prudential Regulation Authority(PRA) and regulated by the PRA and the Financial Conduct Authority (FCA).

You can use Monzo to do the basic things you’d expect from your traditional bank, as well as much, much more.

Is Monzo a credit card?

Monzo is a debit card, but if you’re thinking of getting a credit card, make sure you consider the pros and cons.

Is Monzo good?

Our customers think so! We have a Net Promoter Score (NPS) of +80 (the average across all UK banks in 2017 was just +4). And our customers gave us 5 stars for customer service and communication in Which?’s latest survey!

Is Monzo free?

Opening a Monzo account and using it day-to-day is completely free.

Is Monzo a debit card?

Yes! Monzo is a debit card.

Is Monzo a current account?

Yes. Monzo is a current account and Monzo users who sign up for the current account are issued a Debit Mastercard.

Is Monzo contactless?

Yes! Monzo is contactless, and you can use it to make contactless payments up to £30.

Did you find this useful? Let us know in the community! if you still have Monzo questions that are left unanswered, head to our FAQs or the Simple Questions Thread on the community forum.