We might be heading towards a cashless society, but 40% of all payments in the UK are still made using cash.

And because we don’t have branches, we’ve partnered with PayPoint to give you a quick and convenient way to pay cash into your Monzo account.

How it works

From today, you can pay cash into your Monzo account at any store that shows the PayPoint logo.

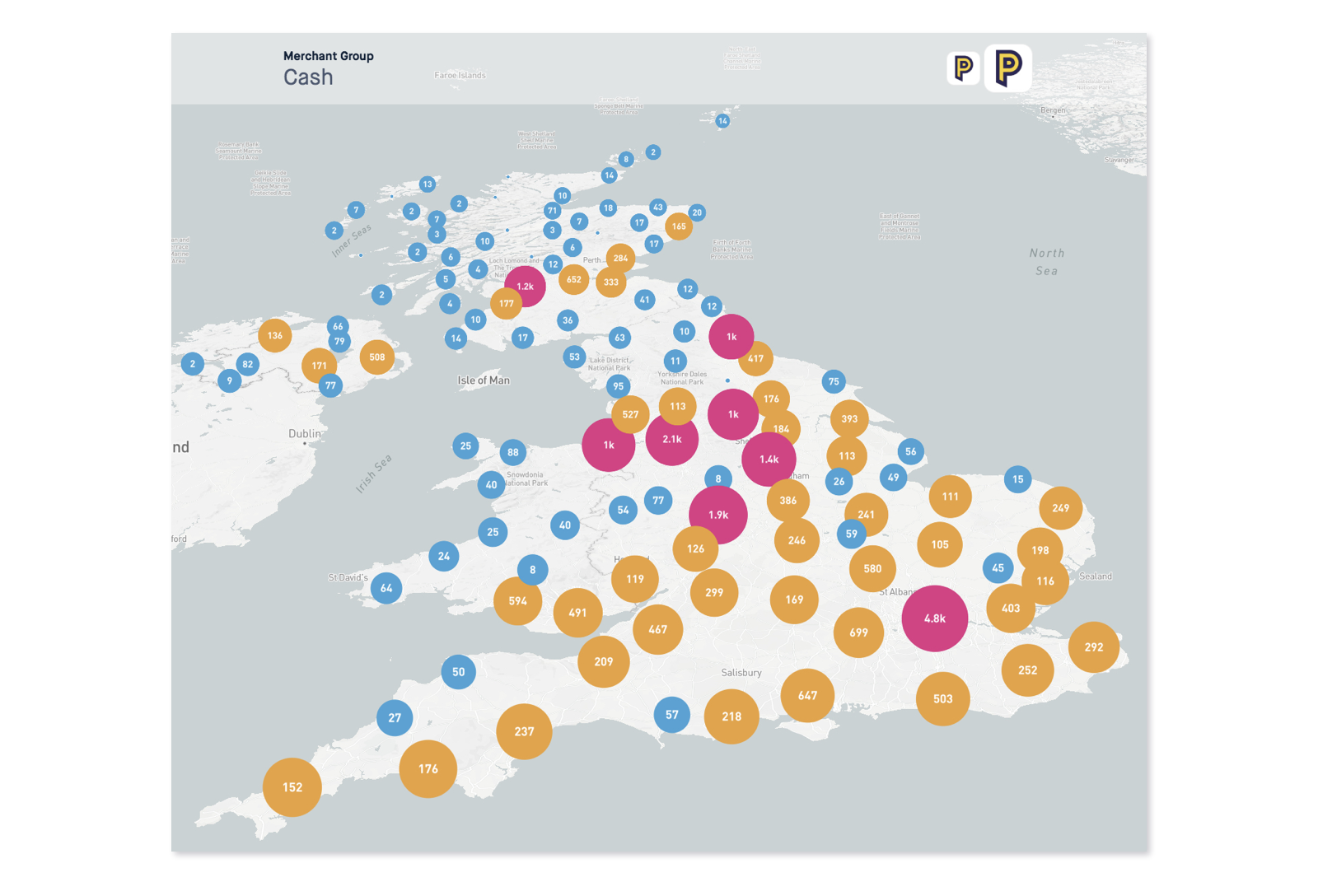

People often use PayPoint to pay for their utilities, like TV licences or electricity bills. It’s available in more than 28,000 corner shops, convenience stores and other retailers across the UK. And lots of locations are open early 'til late, seven days a week.

Paying cash into your account is easy

Go to any shop that displays the PayPoint logo (you might be more familiar with their previous logo, and you can use this handy tool to help you find your nearest store)

Give your Monzo card and your cash to the shopkeeper, who’ll use their PayPoint machine to start making the deposit

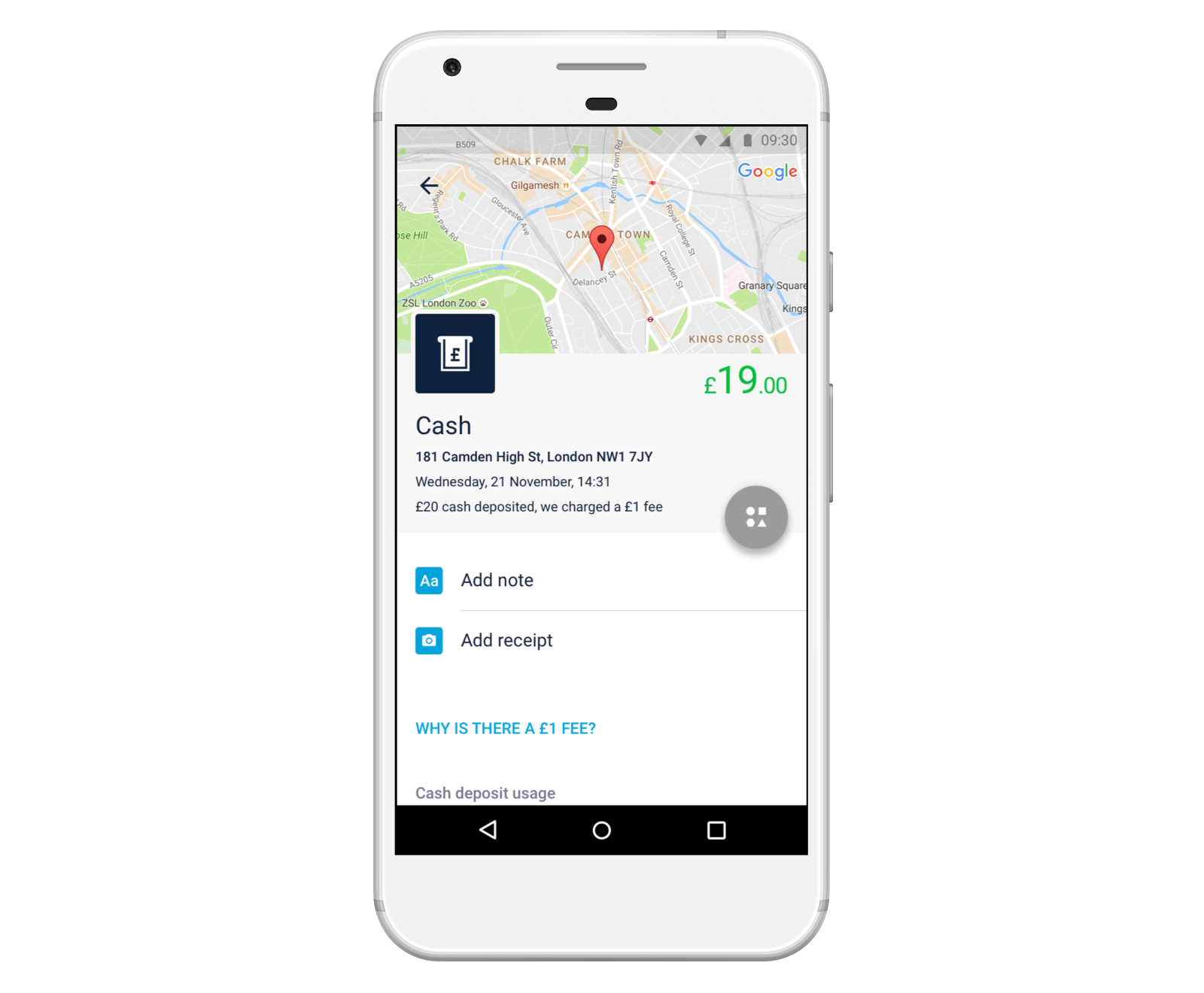

They’ll give you back your card with a receipt, and we’ll send you a notification immediately to confirm you’ve made a deposit

You’ll see the money in your account 10 minutes later, once PayPoint have checked everything’s okay with the deposit

In the future, we want to make the money available in your account immediately. PayPoint need to do some technical work to make that possible, which will hopefully happen next year.

We’ll charge you £1 for each deposit

Working with another company usually comes with costs, and PayPoint charges us for every deposit you make. To help us offer cash deposits in a sustainable way, we’ll pass on some of these costs to you when you use the feature.

We’ll charge you £1 for each deposit you make, and we’ll take the fee out of the money you pay in. So, if you hand £300 over to the shopkeeper, we’ll put £299 in your account.

You can pay in a minimum of £5 and a maximum of £300

You can deposit between £5-300 in one go. And you can pay in a maximum of £1,000 every six months.

If you’re 16-17 years old, that limit is lower, so you can only deposit a maximum of £500 every six months.

These limits help reduce the risk that people will use cash deposits for financial crime, while still making sure they’re useful to most people.

Tell us what you think!

If you’d like to understand more about why we’re charging for this feature and how we decided on our limits, we’ve shared a full explanation here.

Once you’ve given it a try, let us know what you think! Join the discussion and share your feedback with us on the forum.

We believe we can give you everything you need from a bank, without having branches. While keeping costs low and passing the benefits onto you.

Find out more about using a branchless bank. Or download Monzo to give us a try today!