This morning, the Competition and Markets Authority (CMA) reported their provisional findings following a year-long investigation into the retail banking market.

So-called “free banking” has long been criticised by consumer groups, and rightly so. In fact banks earn an average of £128 in revenue from each customer. This £8.7bn of revenue generated by UK current accounts comes predominantly from regressive hidden fees and charges. The poorest and most vulnerable in society are subsidising the rest of us.

Today, the CMA had an opportunity to address this problem. Sadly, they’ve overwhelmingly failed to do so.

Take some example fees and charges:

Up to £25 for each unauthorised overdraft transaction

3% on every purchase or cash withdrawal made abroad

£5 to order a duplicate statement

£50 or more to transfer money abroad

These charges bite most acutely when people are short of money, having lost their jobs or as a result of illness. And when people are in financial difficulty, it’s usually not one charge, it’s a dozen. Penalising people who are already in debt simply exacerbates the problem and causes the kind of downward spiral that resulted in 400,000 people seeking help from Citizens Advice last year.

The reason banks need to charge these fees is to prop up their legacy current account businesses. The thousands of branches and creaky old IT systems aren’t cheap to maintain. But are they necessary? In an increasingly digital world, consumers aren’t convinced.

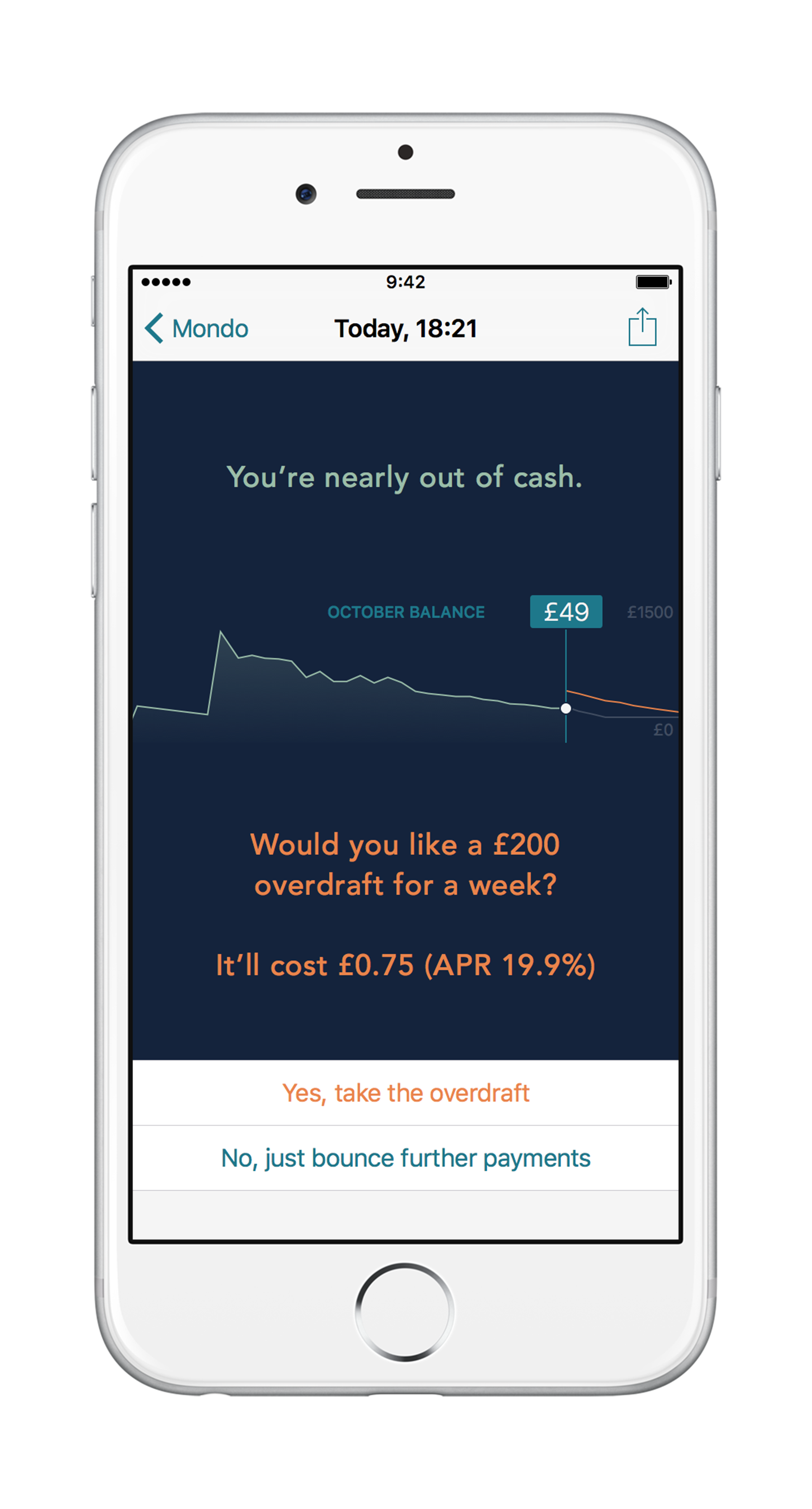

Instead, what the industry needs is a fresh start. Based on modern technology delivered via a mobile phone, your current account can be responsive, proactive and personal. Crucially, it can also be low-cost. Mondo won’t have any hidden fees or charges but will instead make money by lending in a fair, transparent way that puts control back into the hands of our customers.

The CMA’s full report is due in 2016—it's their final chance to put the needs of the customer above banking profits.

We recently updated our name to Monzo! Read more about it here.