This week was a big one for the Mondo team, as we attended the Bank of England for our regulatory Challenge Session.

This is the culmination of many months of hard work and hundreds of pages of regulatory documents. You can find a list of them here!

We met with several senior members of the FCA and PRA, going over our business model and projections with a fine-tooth comb. As the name suggests, the questions were challenging and robust – which feels appropriate for the magnitude of the undertaking.

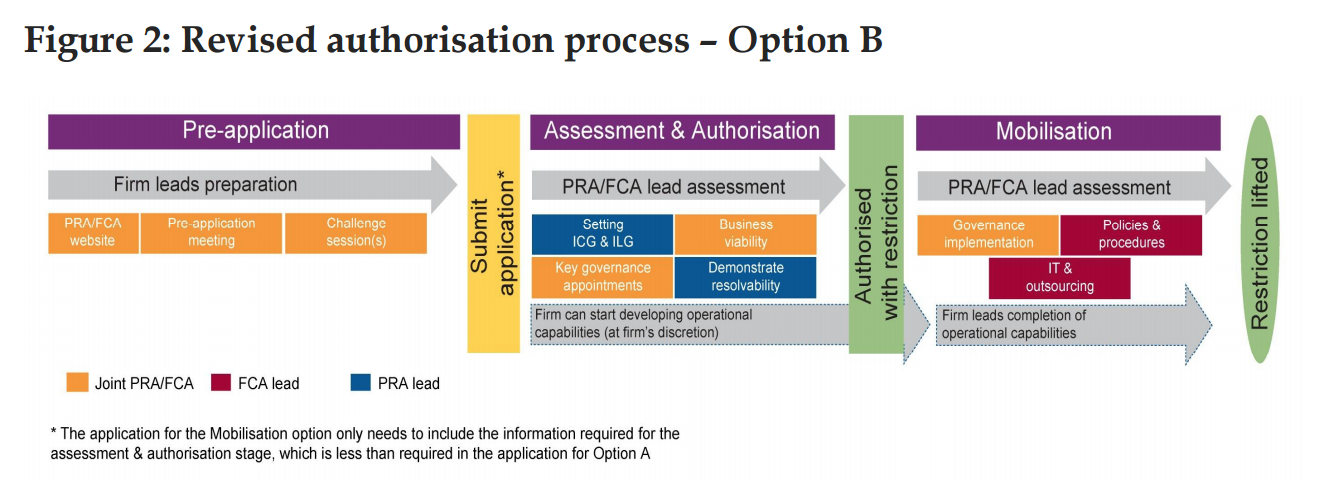

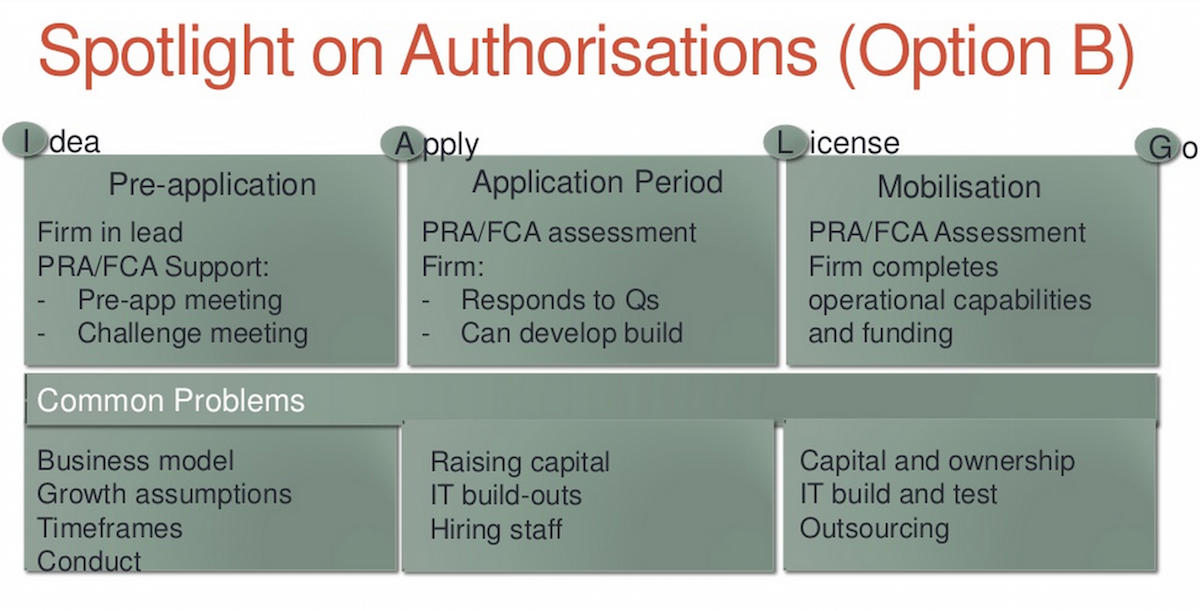

Following a review in March 2013, the Bank of England introduced a two-stage authorisation process for new applicants. Like most new banks, Mondo is following the “Option B” authorisation process. Under this process, the PRA initially grants firms a restricted licence, followed by a period of mobilisation during which they can complete their technology build and put governance and policy structures in place, before launching fully to the public.

The FCA publishes an overview of the application process here.

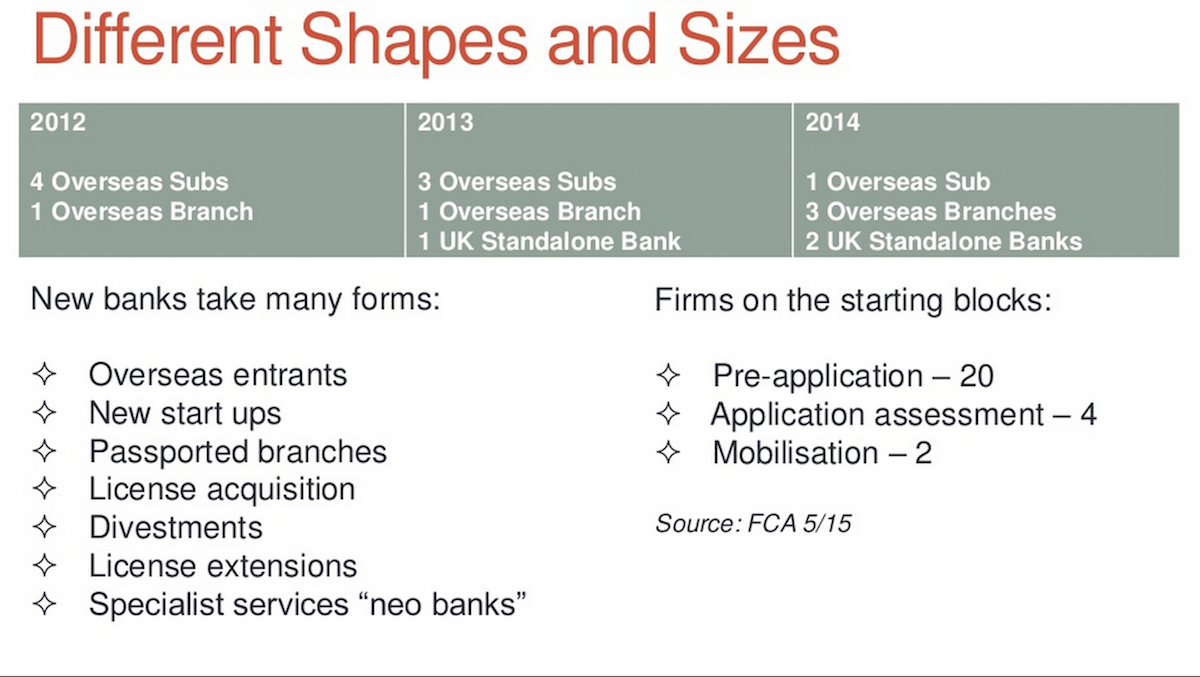

With the news of Atom Bank’s “Authorisation With Restrictions” fresh off the press last week (congratulations!), several of the Mondo team saw Victoria Raffe (previously Director of Authorisations at the FCA) speak about the application process in more detail.

While the total number of firms ultimately being authorised hasn’t changed dramatically over the last few years, we’ve seen a shift away from foreign subsidiaries towards brand-new UK banks.

We’re hoping to launch as a fully-regulated bank in the first half of 2016, and we’ll be building the bank and the app out in the open, with our customers. Follow us on Twitter @monzo for regular updates and a chance to trial the new Mondo card.

We recently updated our name to Monzo! Read more about it here.