Sometimes the only magical thing about money is how quickly it vanishes from your bank account.

But here at Monzo, we want to make banking so surprisingly easy that it feels like full on sorcery.

Here are the Monzo features that'll turn you into a money management mage.

1. We’ll tell you as soon as you spend (and update your balance instantly) 💨

It sounds simple enough, doesn’t it? We notify you when you spend, and update your balance instantly.

But when we first launched Monzo with this feature back in 2015, it felt like a game-changer. And even today it’s still not the norm!

It means you can see exactly how much you’ve spent, as soon as you’ve spent it. And understand how much money’s actually left in your account. So you don’t have to wait around for days to see a payment in your account, and you can always see your accurate balance.

2. Freeze and defrost your card ❄️

Freezing your card stops you from making any payments with your Monzo card. It’s useful if you think you’ve lost your card or it’s been stolen, to help stop anyone spending your hard earned cash.

If your card turns up, you can defrost it from the app. If it doesn’t and you need to get a new one, you can order a replacement too.

3. Sign into Monzo by tapping a magic link (no need to remember a password!) ✨

It might sound weird, but passwords don’t always make things more secure.

They can be hard for you to remember, and easy for fraudsters to guess. Most people don’t follow good password practices, and either reuse passwords, or pick obvious ones (like their birthday). Passwords can also make you more vulnerable to phishing, a type of fraud where someone tricks you into telling them your password.

Plus, you can sometimes reset passwords through your email, which fraudsters can use to work around any protection provided by a password anyway.

That’s why when you log into the Monzo app, we use magic links instead. They’re links we send to your email, that let you log into the app in one click. They keep your app secure, especially if you use two-factor authentication on your email.

Magic links make logging in quick and simple (you don’t have to remember a password or type it in accurately). And you’re unlikely to have your password stolen (because you don’t have one!).

4. Tap your Monzo card on your Android to activate it 💥

When you sign up to Monzo on Android, you’ll see that we’ve used NFC (near field communication) to add a bit of magic to the process.

Rather than typing in the card number or even having to take a picture, simply tap your card and phone together to activate it immediately.

The whole process is made possible by NFC, a technology that lets two devices talk to each other when they’re nearby. It’s what makes contactless payments and features like Android Pay work.

Get Monzo today to try the magic for yourself!

Download Monzo5. Pay your pals who also have Monzo, in a few taps 👯♀️

Rather than doing the awkward back and forth exchanging bank details, you can pay your contacts who’ve also got Monzo in just a few taps.

And when someone pays you, you can even say thanks with an emoji! 🤗

6. Pay people near you, even if you don’t have their number 💸

Through the power of Bluetooth, you can also send and receive payments from people around you – even if you don’t have their number!

It’s a feature called Nearby Friends and it works using Google Nearby, an API service that helps us send messages to other devices near yours. Put simply, it means your Monzo app can see other people using Monzo near you, when you’ve both got the feature turned on.

7. Get your salary a day early ⚡️

Everyone’s wished payday could come early at least once in their lives. And if you get paid into your Monzo account, we can actually make that wish come true!

Thanks to a feature called Paid Early, you can get your salary an entire day early if you get paid into your Monzo account.

Most salaries (and student loans) come into Monzo accounts through a system called Bacs (short for Bank Automated Clearing System). It’s a bit outdated, so from the day your employer sends you the money, it usually takes three days to reach your account.

By 4pm on the day before you’re meant to get your money, we can see it coming in the system and be confident it’ll arrive. And once that happens, we give you the option to get your money sooner! (A heads up: we can stop offering get paid early, or change this service, at any time.)

8. Round up your spending and save the change 🎩

Turn on ‘round-ups’ to automatically save your spare change into a Pot. It’s the modern day equivalent of having a piggy bank stuffed full of pennies.

Every time you pay with Monzo, we’ll round your purchase up to the nearest pound and put the difference in your Pot. It adds up surprisingly quickly!

9. Automatically sort your salary between spending, bills and savings 💫

Salary Sorter lets you neatly sort your money into different Pots for spending, bills and savings, all in one convenient place (your Monzo account!).

It’s useful if you’re trying a budgeting method like piggy banking or the 50/20/30 rule. Or if you simply don’t want to worry about accidentally spending the rent.

Once you set it up, it’ll happen every payday automatically!

You can set up a Bills Pot to set aside money to pay for the essentials. Then when the bill’s due, we’ll automatically move enough money from your Pot into your main account and pay it for you. Easy!

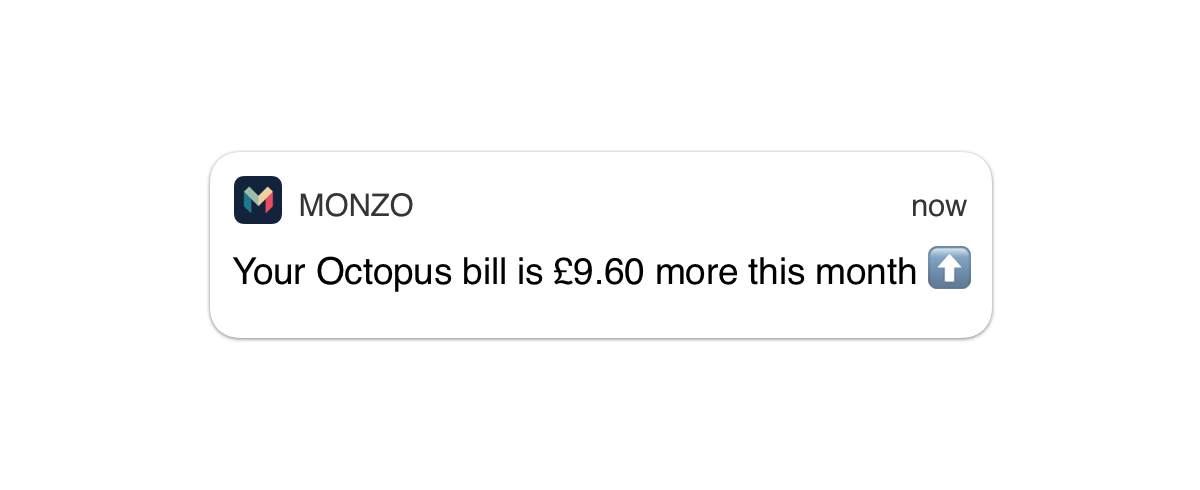

10. We’ll keep an eye on the cost of your bills and tell you when one changes 🔮

We’ll keep track of your regular Direct Debits – like phone contracts and utility bills – and let you know if one of them changes.

So if your energy provider raises their prices, or you rack up a big phone bill while you’re away, you’ll know.

To make use of these magical features, just download Monzo ✨